-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Investors set sights on value stocks as LG Electronics’ shares soar

Undervalued stocks

Investors set sights on value stocks as LG Electronics’ shares soar

By

Dec 08, 2020 (Gmt+09:00)

3

Min read

News+

With South Korea’s stock market indexes at or near all-time highs, finding bargains in the market is a daunting task.

Growth stocks such as battery, bio, Internet and gaming (BBIG) have been market darlings throughout the year, raising valuation concerns. With signs of an economic rebound in Korea and abroad, however, investors are now setting sights on value stocks.

Market analysts say that despite the broader market’s rally in recent weeks, there are some stocks still trading below their intrinsic values, offering bargain hunters potential for outsized gains.

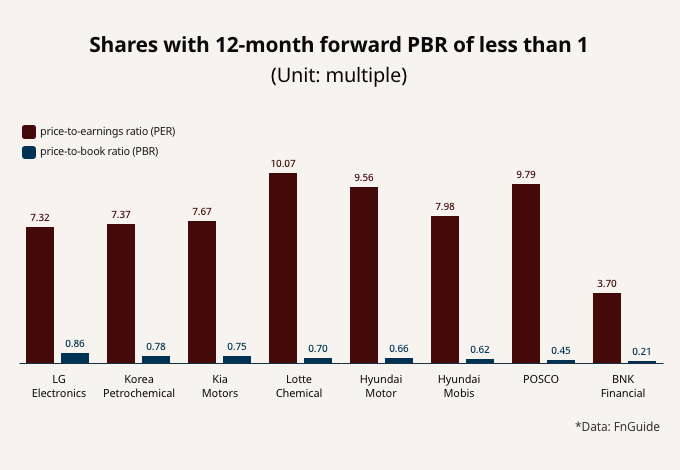

According to market tracker FnGuide, LG Electronics Inc.’s 12-month forward price-to-earnings ratio (PER) is 7.32, much lower than the average forward multiple of 18 for global home appliance makers.

LG’s price-to-book ratio (PBR) is 0.86. Together with PER, the P/B ratio is one of the traditional valuation metrics used to calculate a stock’s valuation. If the ratio falls below 1, it is widely considered that the stock is undervalued.

AUTO COMPONENTS KEY TO LG’S HIGHER PBR

Some analysts expect LG Electronics to post solid earnings on the back of strong sales in its vehicle components division next year, pushing the company’s P/B ratio above 1.

In late October, the consumer electronics giant said its third-quarter revenue and operating profit rose to all-time highs for any July-September period, thanks to steady growth in its television and home appliance segments.

The company is widely projected to post a record operating profit of about 3.16 trillion won ($2.91 billion) for all of 2020, with its profit rising further to 3.6 trillion won next year, according to the market consensus.

“Automakers such as GM, Volkswagen and Hyundai Motor are planning to roll out a series of new electric vehicles next year. This will help LG’s auto parts division swing to a profit, raising LG’s overall operating profit to the 4 trillion won level,” said Ju Min-woo, a Meritz Securities analyst.

Back in 2018, LG’s share price has risen to 114,500 won with its home appliances and TV businesses posting a double-digit increase in profit margin. That resulted in a P/B ratio of 1.46 for the company.

On Tuesday, some bargain hunters snapped up LG Electronics on the main bourse, raising its share price by 8.2% to an intraday high of 96,500 won before closing up 6.5% at 95,000 won, marking the biggest percentage gain in four months. The benchmark Kospi index finished 1.6% lower as investors took profit from recent market rallies.

AUTOS, CHEMICALS, STEEL AMONG BARGAIN STOCKS

Some other sectors that look cheap include automakers, chemical manufacturers and steel makers.

The 12-month forward P/B multiples for Hyundai Motor Co. and Kia Motors Corp. are 0.66 and 0.75, respectively. POSCO, the country’s largest steelmaker, shows a forward P/B multiple of 0.45.

Analysts expect POSCO to post improved earnings next year as the steel industry enters a growth cycle on the back of a global economic recovery and the company’s efforts to diversify business areas.

The P/B multiple of Korea Petrochemical Ind. Co., a global leader in the manufacturing of chemical products such as high-density polyethylene (HDPE), is 0.78.

The company is also forecast to post decent earnings next year owing to rising demand for industrial and consumer plastic goods in the COVID-19 pandemic era.

RISE IN BANK SHARES LONG OVERDUE

Analysts said most bank shares are undervalued, with their PBR hovering below 1 as they remained out of fashion due to the pandemic.

BNK Financial Group Inc., which was excluded from the MSCI Emerging Market Indices during MSCI’s index changes in November, is among bargain stocks, according to analysts.

“BNK’s share price has underperformed compared to its local rivals this year. The bank, with its branches mostly located in southern port cities, will benefit from an expected rebound in the shipbuilding industry,” said Choi Jung-wook, a Hana Financial Investment analyst.

Write to Jae-Yeon Ko at yeon@hankyung.com

In-Soo Nam edited this article.

More To Read

-

CryptocurrenciesRedotPay lands in Seoul with crypto cards

CryptocurrenciesRedotPay lands in Seoul with crypto cardsMay 09, 2025 (Gmt+09:00)

-

May 09, 2025 (Gmt+09:00)

-

Corporate strategyHankook & Company to set up CVC with $11 mn in funding

Corporate strategyHankook & Company to set up CVC with $11 mn in fundingMay 09, 2025 (Gmt+09:00)

-

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South KoreaMay 09, 2025 (Gmt+09:00)

-

May 08, 2025 (Gmt+09:00)