-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Foreigners in year's longest Korean buying streak; chipmakers top picks

Korean stock market

Foreigners in year's longest Korean buying streak; chipmakers top picks

As noted by Morgan Stanley, the end of the chip ice age could come early next year, boosting share prices

By

Oct 19, 2022 (Gmt+09:00)

2

Min read

News+

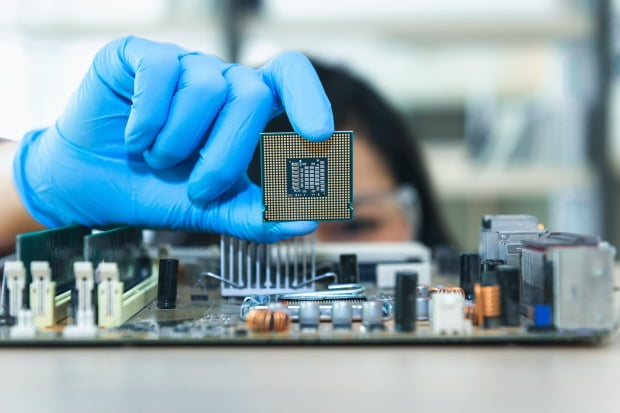

Foreign investors have returned to the South Korean market, snapping up chip industry leaders such as Samsung Electronics Co. and SK Hynix Inc. for 12 consecutive trading days, the longest buying streak so far this year.

According to the Korea Exchange, foreigners have been net buyers on the main bourse since Sept. 29, purchasing as much as 2.26 trillion won ($1.59 billion) worth of shares.

They focused on semiconductor stocks, with Samsung at the top of their buying list at 897 billion won, followed by SK Hynix worth 805 billion won, Samsung SDI Co. with 184 billion won, LG Energy Solution Ltd. at 159 billion won, and KT&G Corp. at 113 billion won.

Foreign net buying of Samsung and SK Hynix – the world’s two largest memory chipmakers – accounted for 75.3% of total foreign purchases in Korea over the past 12 days.

Analysts said investors are betting on an earlier-than-expected end to the chip industry winter, which previously triggered related shares to fall to their troughs.

END OF CHIP ICE AGE IS COMING

In a recent research note, Morgan Stanley said the end of the chip “ice age” is coming.

The US investment bank said it anticipates a semiconductor cycle recovery in the second half of next year, suggesting bargain-hunting in quality stocks “right now.”

A chip recovery, it said, will also be supported by the falling prices of tech products and logistics, and the reopening of economies, especially in China.

Among Korean chip stocks, Morgan Stanley named SK Hynix as its top pick.

Analysts said Korean semiconductor stocks also stand to benefit from growing geopolitical risks surrounding the US and China.

Investors favor Samsung and SK Hynix over Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest foundry player, amid moves by the Biden administration to tighten rules against Chinese companies.

“Deteriorating relations between China and Taiwan following US House Speaker Nancy Pelosi’s visit to Taiwan and the US ban on chip exports to China will have a greater adverse effect on Taiwanese firms than Korean companies,” said HI Investment & Securities analyst Park Sang-hyun.

Write to Sung-Mi Shim at smshim@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Jul 11, 2022 (Gmt+09:00)

-

Korean stock marketSamsung Electronics shares rebound as foreigners turn net buyers

Korean stock marketSamsung Electronics shares rebound as foreigners turn net buyersApr 29, 2022 (Gmt+09:00)

-

Korean chipmakersTime to buy Korean chipmakers; Samsung among 2022 top picks

Korean chipmakersTime to buy Korean chipmakers; Samsung among 2022 top picksJan 03, 2022 (Gmt+09:00)

-

Korean chipmakersChipmakers eye shorter memory downturn

Korean chipmakersChipmakers eye shorter memory downturnDec 21, 2021 (Gmt+09:00)