-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Foreigners turn net buyers of Korean stocks as China reopens borders

Korean stock market

Foreigners turn net buyers of Korean stocks as China reopens borders

They flocked to chip and bank shares; the trend won't continue long term if the listed companies don't increase profits, analyst says

By

Jan 12, 2023 (Gmt+09:00)

2

Min read

News+

South Korean stocks are gaining momentum at the beginning of the new year as foreigners have turned net buyers on expectations of China's border reopening. The main bourse Kospi has jumped over the past eight trading days, since Jan. 2, as foreign investors began bargain hunting, particularly for semiconductor and bank shares.

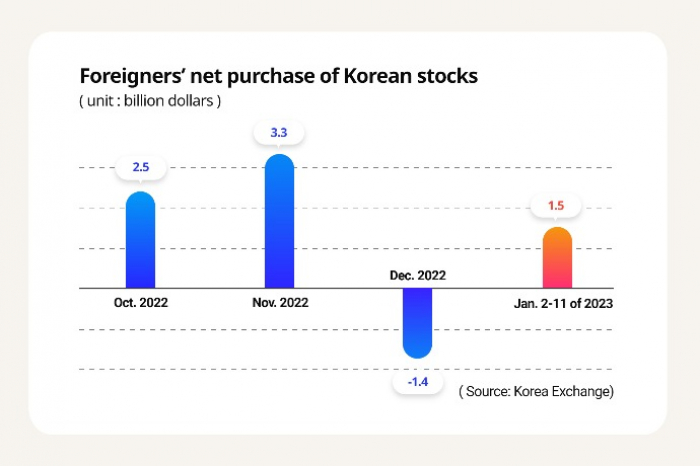

Foreigners net purchased Korean stocks worth 1.82 trillion won ($1.5 billion) between Jan 2. and Jan. 11. The figure is similar to the value of the local stocks they net sold during December 2022, 1.69 trillion won. Backed by foreign net buying, the Kospi has jumped 5.51% to date in January.

The Kospi closed up 0.35% at 2359.53 on Jan. 11, despite Federal Reserve Chairman Jerome Powell's hawkish comments on the same day: "Restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy."

Despite China’s decision earlier this week to suspend issuing short-term visas for Korean visitors, Korean cosmetics, airlines and duty-free shop stocks rose on the expectation of China’s economy reopening to other countries.

Foreigners' demand for Seoul stocks helped the South Korean won currency extend its rebound. The won gained 1.5% against the dollar in the first 11 days of the year after appreciating 14.2% by end-2022 from Oct. 25 of last year, when it hit its weakest level since the 2008-09 global financial crisis.

BARGAIN HUNTING OF SEMICONDUCTOR AND BANK SHARES

Foreign investors are on a net buying spree of the undervalued stocks of the chip and banking sectors this month. Samsung Electronics Co. was foreigners' top pick, with net purchases worth 730 billion won, followed by a net buying of SK Hynix Inc. stocks worth 261 billion won.

KB Financial Group Inc. and Hana Financial Group Inc. stocks ranked third and fourth with net buying of 84 billion won and 79 billion, respectively, on expectations that the financial holding companies will expand dividends.

Foreigners' net buying is expected to continue in the short term if the US consumer price index (CPI) for December 2022, to be announced on Jan. 12, is similar to a 6.6% increase from a year ago, the consensus forecast, as such a result could slow the Fed's rate hike in February.

Experts warn that investors should consider the economic downturn and shrinking profits of listed companies. The recent net buying spree by foreigners is a rebound after sharp declines in the local stock market, and they won't continue to net purchase if there is no steady increase in the companies’ profits, said Yang Hae-jung, an analyst at DS Investment & Securities Co.

Write to Sung-Mi Shim at smshim@hankyung.com

Jihyun Kim edited this article.

More To Read

-

Foreign exchangeKorean won to stay weaker than profitable levels – poll

Foreign exchangeKorean won to stay weaker than profitable levels – pollJan 02, 2023 (Gmt+09:00)

-

Foreign exchangeKorea won near 5-mth high as Powell signals slower hikes

Foreign exchangeKorea won near 5-mth high as Powell signals slower hikesDec 01, 2022 (Gmt+09:00)

-

Nov 11, 2022 (Gmt+09:00)

-

Korean stock marketForeigners in year's longest Korean buying streak; chipmakers top picks

Korean stock marketForeigners in year's longest Korean buying streak; chipmakers top picksOct 19, 2022 (Gmt+09:00)

-

Jul 11, 2022 (Gmt+09:00)