-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korea’s 'Seven Tigers,' next hot stocks: Hyundai Motor Securities

Korean stock market

Korea’s 'Seven Tigers,' next hot stocks: Hyundai Motor Securities

The Korean securities firm foresees solid gains in the seven Korean semiconductor component and equipment stocks

By

Apr 09, 2024 (Gmt+09:00)

3

Min read

News+

Japan may have its Seven Samurai and the US its Magnificent Seven, but South Korea has "Seven Tiger" stocks thanks to the artificial intelligence chip craze driving the overall semiconductor upcycle worldwide, according to Hyundai Motor Securities Co. on Tuesday.

“I have picked seven local companies as ‘Seven Tiger’ stocks with solid upside in both stock price and earnings, like the US' Magnificent Seven and Japan’s Seven Samurai,” said Kwak Min-jeong, an analyst at Hyundai Motor Securities.

The so-called Magnificent Seven stocks are seven US-listed stocks outperforming the broad market and the Seven Samurai stocks are the Japanese equivalent, showing stellar performances.

The Seven Samurai stocks jumped 45.1% on average so far this year, while the Magnificent Seven stocks recorded an average gain of 17.9%.

Over the same period, Korea’s Seven Tiger stocks – Hanmi Semiconductor Co., HPSP Co., Digital Imaging Technology Inc. (DIT), S&S Tech Corp., Leeno Industrial Inc., Gaonchips Co. and Openedges Technology Inc. – climbed 33.6% on average, trailing behind Japan’s Seven Samurai but beating the US Magnificent Seven.

The seven Korean stocks are handpicked among local stocks with a market capitalization of at least 500 billion won ($369 million) and outstanding performances in stock price and earnings growth over the past 12 months, explained Kwak.

Of the Seven Tigers, Hamni Semiconductor boasted the highest gain of 115.4%, followed by Gaonchips with 80.1%, Leeno with 24.2%, DIT with 9.8%, Openedges with 3.7%, HPSP with 1.1% and S&S Tech with 1.0%.

Their average forward price-to-earnings ratio is 28.6 times, lower than the Magnificent Seven’s 30 times and Seven Samurai’s 38.5 times.

This means that Korea's Seven Tiger stocks have room to grow if they show solid performances in revenue and profit in upcoming quarters, said Kwak.

Forward PER uses estimated earnings for the next 12 months to measure a company’s share price relative to its earnings per share.

HANMI AND DIT TOP TWO STOCKS

Hyundai Motor Securities picked Hanmi Semiconductor and DIT as its top picks and then S&S Tech and Leeno Industrial as its next picks.

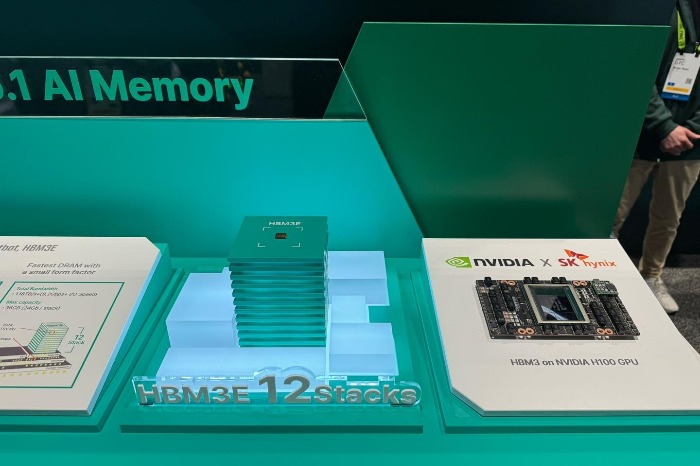

Despite its recent surge, Hanmi Semiconductor's stock has room to grow as it is expected to play an important role in the coalition of Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) and SK Hynix Inc. in high-bandwidth memory chip development, said Kwak.

She expected the stock to be “re-rated as an all-around player” in the global semiconductor equipment sector amid the AI chip boom.

Hyundai Motor Securities also forecast that DIT will benefit from growing demand for laser annealing equipment in line with the growing complexity in the process of thinning wafers and stacking HBM chips.

DIT has developed laser annealing equipment jointly with SK Hynix, the world’s leading HBM chips. It started bagging orders last year.

The US Magnificent Seven stocks are Nvidia Corp., Meta platforms Inc., Amazon.com Inc., Microsoft Corp., Alphabet Inc., Apple Inc. and Tesla Inc.

Japan’s Seven Samurai stocks are Screen Holdings Co., Advantest Corp., Disco Corp., Tokyo Electron Ltd., Toyota Motor Corp., Subaru Corp. and Mitsubishi Corp.

Goldman Sachs has named them Seven Samurai, citing their significant role in lifting the Japanese stock market to its recent heights.

Unlike the Japanese and US peer groups, the Seven Tiger group, however, is only made up of companies in the semiconductor sector, suggesting a possible cap on its rise.

Write to Eunhyeok Ryu at ehryu@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Korean chipmakersHanmi Semiconductor wins $16 mn HBM equipment order from SK Hynix

Korean chipmakersHanmi Semiconductor wins $16 mn HBM equipment order from SK HynixMar 22, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung doubles down in HBM race with largest memory

Korean chipmakersSamsung doubles down in HBM race with largest memoryFeb 27, 2024 (Gmt+09:00)

-

Jan 25, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chip

Korean chipmakersSamsung, SK pin hopes on HBM sales with Nvidia's new AI chipNov 14, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung, Arm partner Gaonchips eyes US as next offshore base

Korean chipmakersSamsung, Arm partner Gaonchips eyes US as next offshore baseMar 10, 2023 (Gmt+09:00)

-

Sep 23, 2022 (Gmt+09:00)