-

KOSPI 2812.05 +41.21 +1.49%

-

KOSDAQ 756.23 +6.02 +0.80%

-

KOSPI200 376.54 +6.64 +1.80%

-

USD/KRW 1373 3.00 -0.22%

MBK to buy Medit at lower price than Carlyle-GS bid

Mergers & Acquisitions

MBK to buy Medit at lower price than Carlyle-GS bid

Unison, Citigroup selected MBK as the preferred bidder to acquire the Korean dental scanner maker after talks with Carlyle-GS failed

By

Nov 29, 2022 (Gmt+09:00)

2

Min read

News+

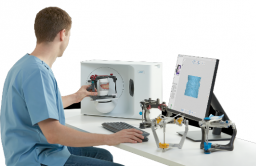

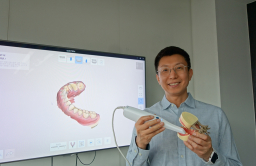

MBK Partners, a leading Asian private equity firm, is set to buy Medit Corp. at a lower price than a bid from the US PE giant The Carlyle Group-led consortium that eventually did not acquire the world’s third-largest 3D dental scanner maker.

South Korean mid-market-focused PE firm Unison Capital Inc., Medit’s top shareholder, and Citigroup Global Markets, the advisor for the deal, on Tuesday selected MBK as the preferred bidder for a 100% stake in the local dental scanning solutions provider, according to investment banking sources.

MBK was known to have offered a bid of about 2.7 trillion won ($2 billion) for the acquisition, lower than the 3 trillion won of the earlier preferred bidder -- a consortium of Carlyle and South Korean energy-to-retail conglomerate GS Group, the sources said.

MBK and Unison aim to sign a final deal later this year with a target to conclude the transaction in early 2023.

The seller last month chose the Carlyle-GS consortium as the preferred bidder for Medit, but they failed to sign a final agreement after the South Korean dental scanner maker’s earnings in October missed the target suggested by the company during the sale process by 40%, sources said.

Unison quickly started negotiations with other bidders such as global PE firm Kohlberg Kravis Roberts & Co. (KKR), as well as new investors including MBK after talks with the Carlyle consortium failed.

LONG-TERM GROWTH POTENTIAL

MBK was known to focus on Medit’s growth potential for the long term, industry sources said. Its sales in the first 10 months jumped more than 50% from a year earlier after an increase of some 20% in October alone. Sales for full-year 2022 are forecast to surge 60% on-year.

“The dental scanner market is expected to steadily expand, given the aging society and interest in healthcare,” said an investment banking industry source. “Medit will continue to grow for the time being, although the speed may vary.”

Medit, founded in 2000, has been accelerating growth through active expansions in overseas markets since 2019 when Unison bought a controlling stake for 320 billion won. In July of this year, Unison put Medit on the market with an expected price tag of up to 4 trillion won.

Medit’s earnings before interest, taxes, depreciation and amortization (EBITDA) nearly tripled to 103.9 billion won last year from 36.7 billion won in 2019 with sales more than doubling to 190.6 billion won last year from 72.2 billion won during the period.

(Updated with bid prices of MBK and Carlyle-GS consortium in the third paragraph)

Write to Chae-Yeon Kim at why29@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Mergers & AcquisitionsSale of Korean dental scanner maker Medit fails

Mergers & AcquisitionsSale of Korean dental scanner maker Medit failsNov 14, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsCarlyle, GS Group to buy Korean dental scanner maker

Mergers & AcquisitionsCarlyle, GS Group to buy Korean dental scanner makerOct 25, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsCarlyle, KKR again compete for Korean dental scanner maker

Mergers & AcquisitionsCarlyle, KKR again compete for Korean dental scanner makerOct 19, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsCarlyle, GS team up to buy Korean dental scanner maker

Mergers & AcquisitionsCarlyle, GS team up to buy Korean dental scanner makerAug 16, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for sale

Mergers & AcquisitionsUnison Capital puts Korea dental scanner maker up for saleJul 05, 2022 (Gmt+09:00)