-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korea Zinc, MBK face proxy war for zinc smelter

Neither of Korea Zinc and MBK is likely to seize a majority stake in Korea Zinc, say analysts

By

Oct 28, 2024 (Gmt+09:00)

Korea Zinc Inc.'s face-off with an MBK Partners-led consortium over control of the world’s largest zinc smelter looks set to escalate into a lengthy proxy fight after the two sides failed to secure a majority in tender offers.

In a regulatory filing on Monday, Korea Zinc said it had bought back shares equivalent to a 11.26% stake, including a 1.41% stake bought by Bain Capital, in the market over the past three weeks. The 2.1 trillion won ($1.5 billion) repurchase falls short of its target of 20%.

Korea Zinc teamed up with the US private equity firm to counter a takeover bid by a consortium between North Asia-focused buyout firm MBK and Young Poong Corp., its largest shareholder with a 25.4% stake.

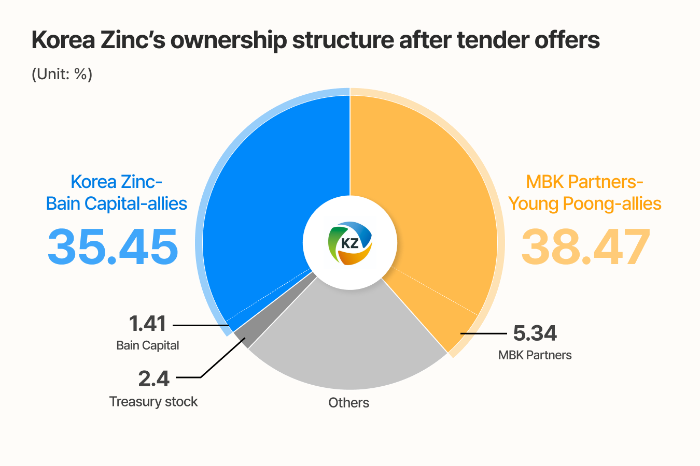

Given that companies are not allowed to exercise shareholder rights for treasury stocks, their repurchase increased the stake with voting rights, held by Korea Zinc Chairman Choi Yun-birm, stakeholders, Bain Capital and those that support its current management, to 35.45% from 33.99%.

That is more than 3 percentage points less than the 38.47% stake secured by the MBK-Young Poong coalition after completing their tender offer earlier this month. MBK tendered the zinc smelter's shares at 830,000 won apiece, 7.3% below Korea Zinc's offer of 890,000 won.

TREASURY STOCK CANCELLATION

After Korea Zinc cancels the treasury stocks it bought back, as promised, shares held by Korea Zinc’s Choi and his allies, including Hyundai Motor Co., will represent a 41.5% stake. That compares with the 45% controlled by the MBK-Young Poong consortium and their allies.

Amid the intense duel, the MBK-led group is said to convene an extraordinary shareholder meeting. It will strive to win over institutional investors such as the National Pension Service (NPS), holding about a 4% stake in Korea Zinc, to secure management rights.

But analysts said neither of the MBK-led group and the Korea Zinc-Bain Capital consortium is likely to seize more than a 50% stake in Korea Zinc in the market due to its share price surging far above their bids and reduced free float.

Its share price soared to as high as 1,359,000 won on Monday morning, off its record-high 1,470,000 won notched on Friday.

Its free float is about 14%, including the NPS’ 4%.

If the NPS backs the Korea Zinc-Bain Capital consortium in the proxy contest, the lead smelter will gain the upper hand over the MBK-Young Poong coalition. But that may not ensure its victory.

The MBK-Young Poong consortium breathed a sigh of relief after the Korea Zinc-Bain Capital counterpart failed to hit their buyback target.

"The results confirmed that a majority of its shareholders did not support Chairman Choi Yun-birm's buyback offers with the aim of maintaining his management rights, which incurred financial losses on the company," it said in a statement.

If the MBK-led group ultimately seizes control of Korea Zinc, it would mark its first success in a hostile takeover of a domestic company.

Write to Sang-Hoon Sung at uphoon@hankyung.com

Yeonhee Kim edited this article

-

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knights

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knightsOct 27, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc shares skyrocket after buybacks in tender offer

Mergers & AcquisitionsKorea Zinc shares skyrocket after buybacks in tender offerOct 24, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBK

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBKOct 22, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea Zinc

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea ZincOct 14, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBK

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBKOct 11, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warning

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warningOct 10, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twist

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twistOct 04, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offer

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offerOct 04, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBK

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBKOct 02, 2024 (Gmt+09:00)

-

Leadership & ManagementHankook vows to prevent hostile bids after MBK tender offer fails

Leadership & ManagementHankook vows to prevent hostile bids after MBK tender offer failsDec 26, 2023 (Gmt+09:00)