-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

MBK kicks off Lotte Card sale for about $1.4 bn in 2nd bid

Mergers & Acquisitions

MBK kicks off Lotte Card sale for about $1.4 bn in 2nd bid

KB Financial and Hana Financial are floated as strong candidates for South Korea’s fifth-largest credit card issuer

By

Dec 02, 2024 (Gmt+09:00)

4

Min read

News+

Lotte Card Co. is expected to be up for grabs in the first half of next year amid a second sale attempt by its largest shareholder MBK Partners, a North Asia-focused private equity firm, some two years after its first divestment bid failed.

According to investment banking and credit card industry sources on Monday, MBK Partners has selected UBS as its advisory firm to lead the Lotte Card sale.

“MBK Partners is very determined to sell Lotte Card,” said an IB industry official who declined to be named. “After the year-end leadership reshuffle ends, Lotte Card’s sale process is expected to pick up speed in the first half of next year.”

This is MBK Partners’ second bid to sell Korea’s fifth-largest card issuer, whose value is estimated to be 2 trillion won ($1.4 billion).

MBK put Lotte Card up for sale in 2022, three years after its takeover, with an asking price of more than 3 trillion won. But the sale fell through due to its high price tag.

Given Lotte Card’s over-9.5 million cardholders, its sale is expected to upend the Korean credit card market, which is tightly controlled by five big players, industry observers said.

MBK-WOORI CONSORTIUM WITH AN 80% STAKE

In 2019, MBK Partners acquired Lotte Card, which had been put up for sale by its former owner Lotte Group, which was seeking to transform into a holding company at the time. Under Korean law, a non-financial holding company is prohibited from owning both non-financial and financial subsidiaries.

The Korean PE firm formed a consortium with Woori Bank to own the largest stake of 79.83% in Lotte Card for 1.75 trillion won.

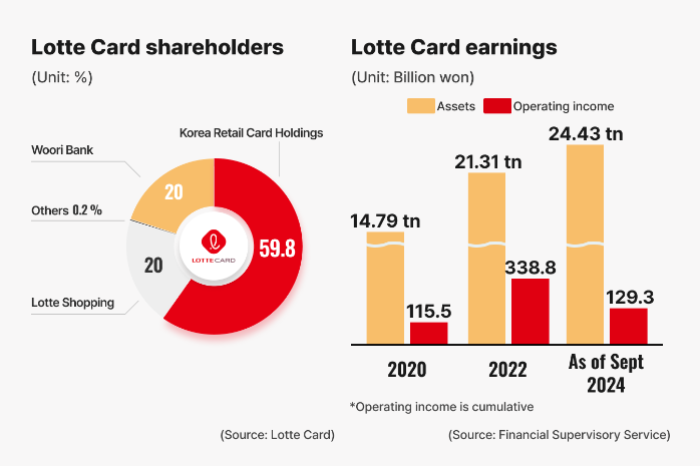

MBK Partners now holds 59.8% of Lotte Card through Korea Retail Card Holdings Inc., a special purpose company set up by the PE firm, while Woori Bank holds 20%. The remaining 20% is held by Lotte Shopping Co.

Following its acquisition, MBK restructured Lotte Card's business and applied digital technology to its business and operation processes, backed by aggressive marketing efforts.

Lotte Card’s net profit jumped nearly fivefold to 241.4 billion won in 2021 from 51.7 billion won in 2019. Its total equity value, a measure of a credit card firm's valuation, stood at 2.4 trillion won at the end of 2021.

After the successful restructuring, MBK looked for a new owner for its stake in 2022 in hopes of fetching more than 3 trillion won but the sale bid was called off.

KB AND HANA AS STRONG CONTENDERS

With a strong resolve to exit, MBK Partners is said to be willing to sell Lotte Card at a lower price than its asking price two years ago.

Lotte Card’s assets have nearly doubled to 24.43 trillion won as of September 2024 versus 14.79 trillion won at the end of 2020.

It boasts more than 9.5 million cardholders as of October this year, making it the country's fifth-largest behind rivals Shinhan Card Co. with 14.39 million, Samsung Card Co. with 13.04 million, Hyundai Card Co. with 12.49 million and KB Kookmin Card Co. with 12.39 million cardholders.

It is also the No. 5 card issuer with a 10.5% share of the domestic credit card payments market in terms of total transaction value.

“Of all the financial companies up for grabs now, Lotte Card is the only financial institution with a more than 10% market share,” said a Korean financial industry official.

KB and Hana are being floated as strong candidates for Lotte Card, according to industry observers.

With Lotte Card under its wings, the country’s fourth-largest issuer KB Kookmin Card could rise to the country's No. 1, surpassing the current leader Shinhan Card.

Owning Lotte Card would allow KB Financial Group Inc. to significantly widen its gap with Shinhan Financial Group Co. to become Korea’s unrivaled No. 1 financial holding firm.

For this reason, Shinhan Financial is also expected to consider snatching Lotte Card to cement its leadership.

Hana Financial Group, Korea’s third-largest financial group with a weak presence in Korea's non-banking financial market, is expected to re-attempt to grab Lotte Card.

Hana competed with the MBK-Woori consortium for Lotte Card in 2019 and entered the race for Lotte Card again in 2022 when MBK tried to sell it. But both bids failed. Another potential bidder is Woori Financial Group.

MBK Partners is said to be mulling the sale of its stake in Lotte Card together with Woori Bank's and Lotte Shopping’s combined 40% stake.

Lotte Shopping has tag-along rights to participate in the Lotte Card sale initiated by the largest shareholder MBK.

Lotte Shopping’s stake sale of Lotte Card would help ease liquidity concerns about its parent Lotte Group.

Write to Hyeong-Gyo Seo, Mi-Hyun Jo and Jun-Ho Cha at seogyo@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Private equityMBK Partners’ 6th buyout fund raises $5 bn at 2nd close

Private equityMBK Partners’ 6th buyout fund raises $5 bn at 2nd closeNov 19, 2024 (Gmt+09:00)

-

Banking & FinanceHana Financial mulls non-banking M&As for growth: CEO

Banking & FinanceHana Financial mulls non-banking M&As for growth: CEOJul 12, 2024 (Gmt+09:00)

-

Feb 08, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsLotte Card seeks to sell transportation card subsidiary

Mergers & AcquisitionsLotte Card seeks to sell transportation card subsidiarySep 25, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsLotte Card draws bid from Hana as key candidates back off

Mergers & AcquisitionsLotte Card draws bid from Hana as key candidates back offSep 07, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsMBK seeks to exit Korea’s Lotte Card for over $2.5 bn

Mergers & AcquisitionsMBK seeks to exit Korea’s Lotte Card for over $2.5 bnMar 31, 2022 (Gmt+09:00)