-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

LG Chem beats CATL, Panasonic to supply batteries for Tesla’s Model Y SUV

EV batteries

LG Chem beats CATL, Panasonic to supply batteries for Tesla’s Model Y SUV

By

Nov 20, 2020 (Gmt+09:00)

3

Min read

News+

South Korea’s LG Chem Ltd. will supply batteries to US electric vehicle giant Tesla Inc. for its latest mid-size SUV Model Y, to be manufactured in China next year.

LG Chem, the world’s largest EV battery maker, has been chosen as the sole supplier for the luxury SUV model, beating strong contenders such as China’s Contemporary Amperex Technology Co. (CATL) and Japan’s Panasonic Corp., according to industry sources on Nov. 20.

The value of the deal was not known, but based on the model’s expected annual sales volume, the contract is estimated at around 3 trillion won ($2.7 billion) a year.

The deal marks LG Chem’s second contract with Tesla, following its agreement in 2019 to supply batteries for the Tesla Model 3 sedan, currently the US firm’s bestselling model.

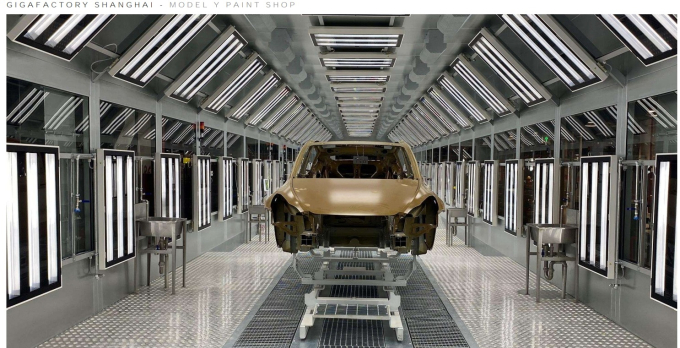

Under the latest deal, LG Chem will supply advanced lithium-ion batteries, known as NCM (nickel cobalt manganese) batteries, for the Model Y to be produced at Tesla’s Gigafactory Shanghai facility in the first quarter of 2021, sources said.

At its US factory in California, Tesla began producing the fully electric SUV at the start of this year.

CATL, China’s leading battery maker, had been tipped as one of the strongest candidates, but was excluded as a supplier as it focuses on a different, low-cost type of battery, known as LFP (cobalt-free lithium-iron-phosphate).

TECHNOLOGICAL EDGE

Industry watchers say the selection of LG Chem as the only supplier for the Tesla Model Y signals its technological prowess as the SUV, priced at around 95 million won, is 25% heavier than the Model 3 sedan, meaning that it requires high-end batteries that provide a longer travel distance per charge.

“CATL’s LFP-type batteries cannot support the Model Y’s weight and performance. The latest deal proves LG Chem’s technological edge over its rivals,” said a local battery industry official.

Currently, Tesla uses CATL-made LFP cells for its low-end made-in-China Model 3 sedans, while outsourcing batteries from LG Chem for high-end Model 3 vehicles, also made in China.

DEAL TO BOOST LG CHEM’S PRESENCE IN CHINA

The latest contract is expected to boost LG Chem’s presence in China, the world’s largest electric vehicle market.

“Tesla’s EV sales in China are forecast to rise 76% to 880,000 units in 2021 from this year. Of the projected volumes, the Model Y will account for 360,000 units,” said China’s Tianfeng Securities.

In China, where its government provides subsidies to nurture local EV battery makers, CATL leads the market with 48.3% share, followed by BYD Co. at 14.0% and LG Chem at 9.5%. With the latest deal, LG Chem is expected to move up one notch to second place.

The Chinese government recently announced that it will extend state subsidies to its battery makers until the end of 2022. Such subsidies were scheduled to be phased out by the end of 2020.

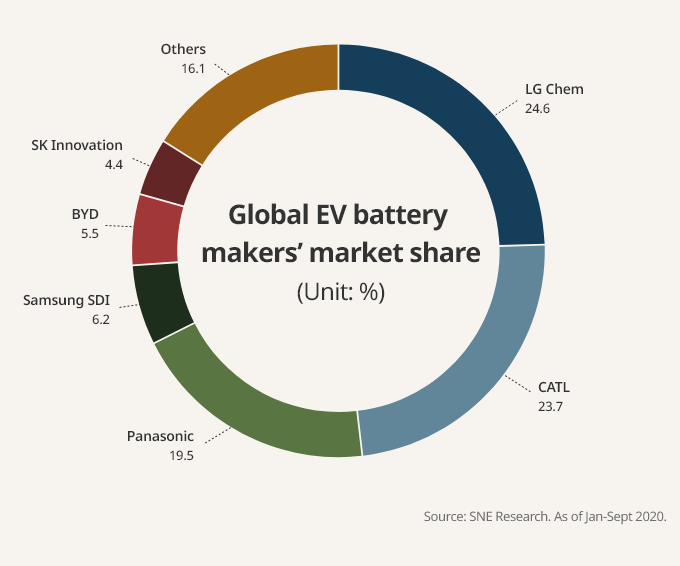

Globally, LG Chem is the No. 1 EV battery maker with 24.6% market share as of the end of September, according to market research firm SNE Research.

CATL ranks second with 23.7%, followed by Panasonic (19.5%), Samsung SDI (6.2%), BYD (5.5%) and SK Innovation (4.4%).

Tesla Chief Executive Elon Musk said at the company’s annual Battery Day in September that it will make next-generation batteries for its electric cars in-house to cut costs.

MORE DEALS LIKELY FROM TESLA

Analysts said the Tesla move is aimed at alleviating the expected short supply from other makers, rather than cut ties with suppliers, as the US company plans to aggressively raise its EV production volumes.

Last month, LG Chem executives said the company is working on a new form-factor cylindrical cell, raising market speculation that it may supply a new type of batteries to Tesla.

In an effort to widen its lead in the EV battery market, LG Chem plans to expand its battery production capacity to more than 260 GWh by the end of 2023 from 100 GWh this year.

LG Chem, set to launch its battery business as a separate subsidiary on Dec. 1, aims to raise its battery revenue to 30 trillion won by 2022 from an estimated revenue of 13 trillion won this year.

Write to Man-Su Choe at bebop@hankyung.com

In-Soo Nam edited this article.

More To Read

-

CryptocurrenciesRedotPay lands in Seoul with crypto cards

CryptocurrenciesRedotPay lands in Seoul with crypto cards20 HOURS AGO

-

22 HOURS AGO

-

Corporate strategyHankook & Company to set up CVC with $11 mn in funding

Corporate strategyHankook & Company to set up CVC with $11 mn in funding24 HOURS AGO

-

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South Korea

Electric vehiclesBYD’s Atto 3 overtakes Tesla’s Model Y as best-selling EV in South KoreaMay 09, 2025 (Gmt+09:00)

-

May 08, 2025 (Gmt+09:00)