-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Hyundai Heavy endures to be likely buyer of Doosan Infracore

By

Nov 24, 2020 (Gmt+09:00)

The remaining two bidders are a consortium of Hyundai Heavy with the state-run Korea Development Bank (KDB), and the South Korean construction materials maker Eugene Group.

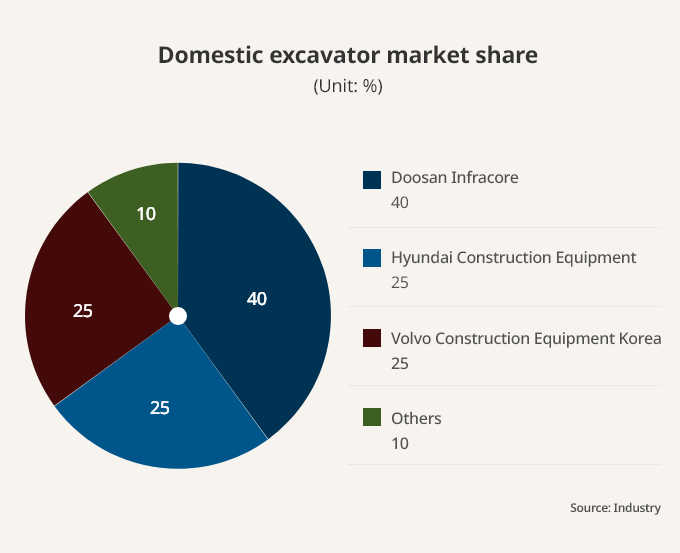

Hyundai Heavy has been eyeing Doosan Infracore from the beginning — as if it merges with the group's affiliate Hyundai Construction Equipment Co., it could become one of the leading companies in the global construction equipment market with a combined 4.5% market share.

"We hope to boost our presence and compete with industry powerhouses in the global market by adding Doosan Infracore to our portfolio," said a Hyundai Heavy official.

Industry sources say that cards are stacked in favor of Hyundai Heavy given its deep pockets, backed by financial investor KDB and potential synergy with Doosan Infracore's construction equipment operations.

The deal price is estimated to be worth up to 1 trillion won ($900.5 million) including a premium for management control.

However, the main hurdle for Hyundai Heavy will be dealing with anti-competitive concerns that are likely to arise from the deal since it will hold around a combined 60% market share in the domestic excavator market.

Under the country's Monopoly Regulation and Fair Trade Act, a company is considered to have a market-dominant position if its market share exceeds 50%, meaning that the merger will be subject to review by the Korea Fair Trade Commission (KFTC).

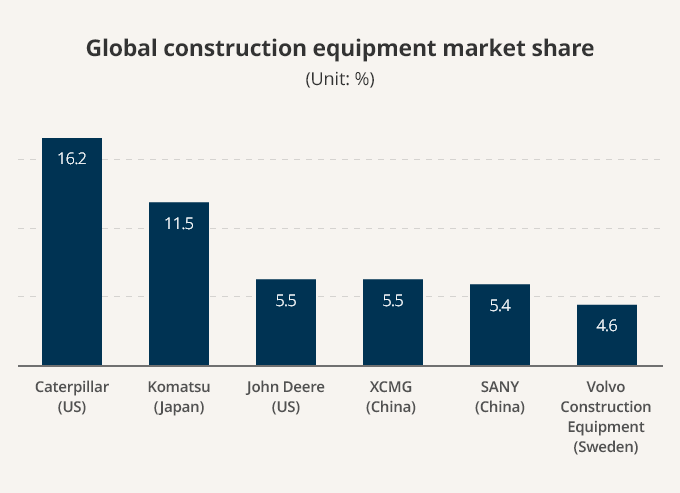

Despite such concerns, a Hyundai Heavy official said that the deal should proceed smoothly given that the two companies' global market shares are not high compared to larger peers, such as US-based Caterpillar and Japan-based Komatsu, which account for 16.2% and 11.5% of the market, respectively.

Meanwhile, shortlisted bidders including GS Engineering & Construction Co. alongside domestic private equity firms MBK Partners and Glenwood Private Equity did not participate in the final bid due to uncertainties such as the legal dispute surrounding Doosan Infracore’s China-based operations.

The stake sale in Doosan Infracore is part of Doosan Group's efforts to keep the debt-laden Doosan Heavy Industries & Construction Co. afloat. The group pledged to raise 3 trillion won through the sale of core assets and paid-in capital increases in return for a 3.6 trillion won bailout from creditors.

In addition to Doosan Infracore's stake sale, the group is also seeking potential buyers for construction affiliate Doosan Engineering & Construction Co. and plans to raise 1.3 trillion won through right issues by year-end.

Write to Jun-ho Cha and Man-su Choe at bepop@hankyung.com

Danbee Lee edited this article.

-

Mergers & AcquisitionsMubadala, Goldman Sachs to invest $700 mn in Kakao Mobility

Mergers & AcquisitionsMubadala, Goldman Sachs to invest $700 mn in Kakao MobilityMay 09, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slump

Mergers & AcquisitionsKorea’s top cinema chains seek merger to counter box office slumpMay 08, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operator

Mergers & AcquisitionsSoon for sale: Altos Ventures-backed Cafe Knotted operatorMay 07, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio push

Mergers & AcquisitionsHarman acquires Masimo’s audio arm in Samsung’s car audio pushMay 07, 2025 (Gmt+09:00)

-

May 06, 2025 (Gmt+09:00)