-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korean 20-somethings raising stakes in OTC stocks

By

Mar 19, 2021 (Gmt+09:00)

A growing number of South Koreans in their 20s are further increasing risk tolerance to stocks, crowding into over-the-counter (OTC) markets, in anticipation of winning the jackpots from their initial public offerings.

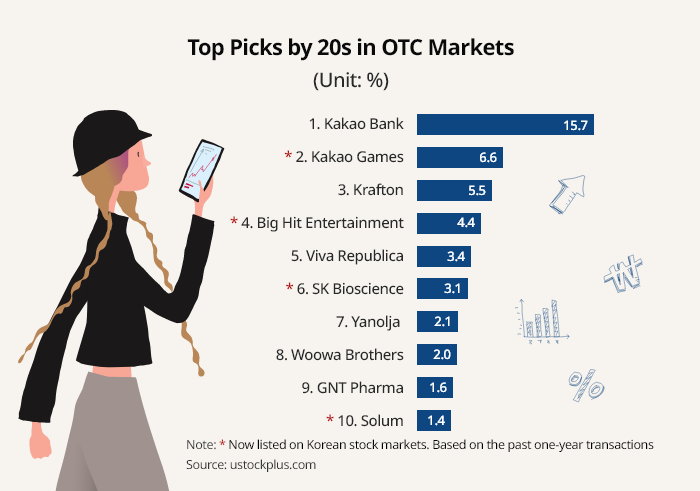

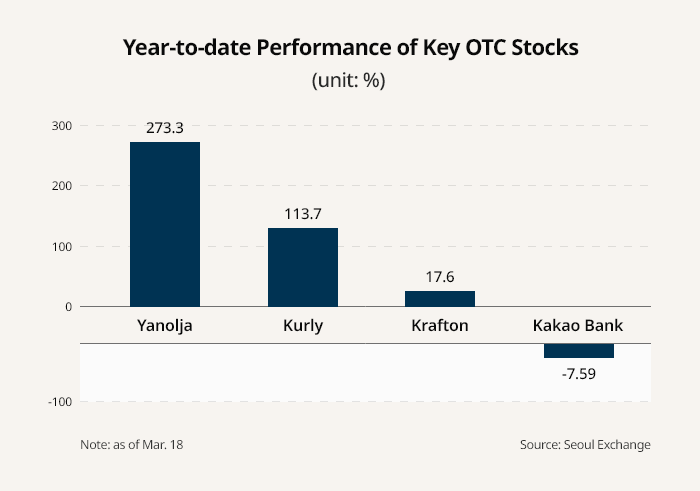

The twentysomethings are shifting away from the main Kospi bourse which has been rangebound just above the 3,000 point mark since the beginning of the year. They are scooping up their familiar names such as Kakao Bank, Krafton Inc. and Yanolja, the country's largest travel platform, which are preparing IPOs. Yanolja has skyrocketed 273% on an OTC platform year to date.

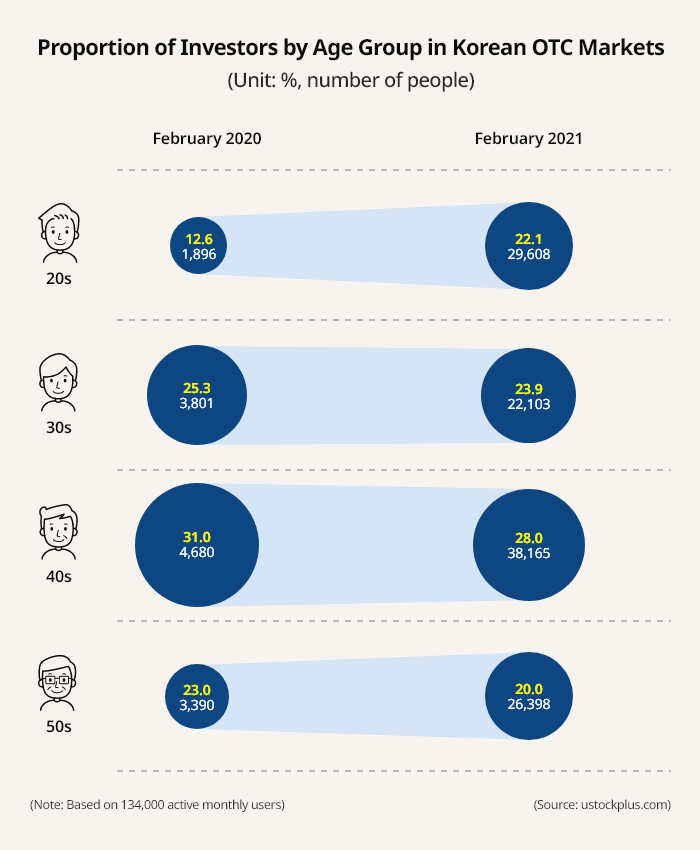

Overall, the number of active users in South Korean OTC markets, where unlisted stocks are exchanged, soared across all age groups. But the pace of growth was notable among the twenty somethings. They were the only age group that expanded presence among Korean OTC stock investors.

According to a popular domestic OTC stock trading platform www.ustockplus.com on Mar. 18, the number of its active monthly users in their 20s soared to 29,608 as of February 2021, nearly a 16-fold rise from 1,896 a year earlier.

In total, the number of its users rose to 134,000, almost a nine-fold increase from 15,000 during the same period.

RED-HOT IPO MARKET

Korean retail investors have emerged as an influential group of active stock investors, shedding their image of the usual losers. Among them, the twenty somethings focused on their favorite companies such as game and media firms.

Last year, their betting on SK Bioscience, Big Hit Entertainment, the label behind the global boy band BTS and Kakao Games paid off. SK Bioscience doubled its IPO price on its first trading day on Thursday.

Now they are raising their stakes in pre-IPO stocks for bigger gains.

OTC markets are seen as the last resort for young adults to earn substantial capital gains, after they missed out on the rallies in real estate and listed stock markets.

Compared with their stagnant labor income growth, the skyrocketing real estate and stock markets opened their eyes to investments and capital gains.

OVERVALUED?

Shares in Yanolja, which is looking to list by the end of this year, have more than doubled over the past month, according to Seoul Exchange, another popular Korean OTC market. Its market capitalization comes to 7.3 trillion won ($6.5 billion).

Kurly Inc., better known by its brand name Market Kurly, saw its share price up 113% since the start of the year. Its share price has trebled over the past year as the premium food delivery startup is looking for a global investment bank to prepare a US listing.

But venture capitalists cautioned against the rush into startups or unlisted stocks because of a lack of their financial details. It is quite often to see the same company's stock traded at different prices at different OTC platforms.

"There are many good companies out there, but we are hesitating to invest in them because of valuations," said a venture capital firm source.

They advise OTC stock investors to compare OTC-traded companies' market capitalization with their listed rivals', and check in advance whether VC firms with track records have already invested in them.

Write to Eui-Myung Park at uimyung@hankyung.com

Yeonhee Kim edited this article.

-

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stake

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stakeApr 29, 2025 (Gmt+09:00)

-

Apr 25, 2025 (Gmt+09:00)

-

Apr 25, 2025 (Gmt+09:00)

-

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talks

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talksApr 25, 2025 (Gmt+09:00)

-

Apr 24, 2025 (Gmt+09:00)