-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

South Korea's secondary battery exports reach all-time highs for 5 years in a row

Mar 30, 2021 (Gmt+09:00)

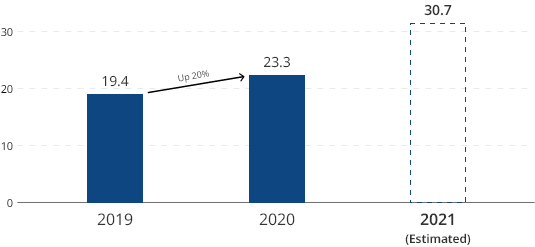

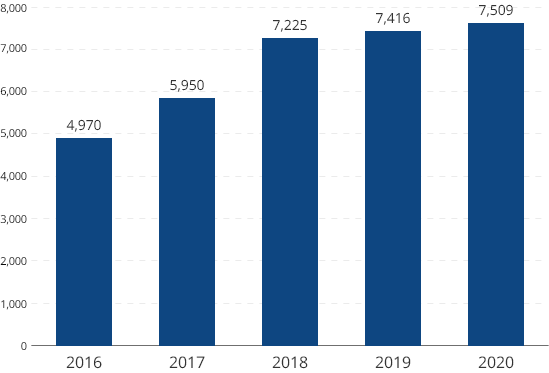

K-Battery sets all-time highs in exports for 5 years in a row

Despite worsening economic conditions due to the COVID-19 crisis, South Korea’s secondary battery business saw a rise in its key indicators, including production, export and domestic demand. Last year, Korean companies’ global production volume for secondary batteries stood at 23.3 trillion won ($21 billion), climbing more than 20% from the 19.4 trillion won in 2019. The export volume has continued to grow for five straight years, standing at $7.5 billion. The EV lithium-ion battery drove the overall export volume due to the growing market size of global electric vehicle (EV) and battery electric vehicle (BEV) market. The solid export performance is owing to Korean firms being prepared to meet the demands of the rapidly growing EV battery markets in major economies, including in Europe, the US and in China.

Source: Ministry of Trade, Industry and Energy

Secondary battery production

Lithium-ion battery, lead-acid battery (excluding components)

(Unit: Trillion Korean won)

Secondary battery exports

Lithium-ion battery, lead-acid battery (including components)

(Unit: $1 million)

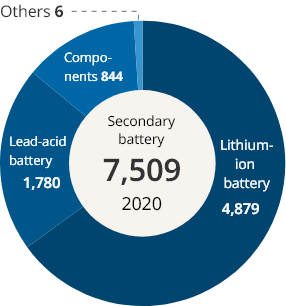

EV lithium-ion battery drives exports

(Unit: $1 million)

Secondary batteries are rechargeable batteries. Lithium-ion batteries and lead-acid batteries are primary examples of secondary batteries. Lithium-ion batteries have become the leading force amid the growing EV market, accounting for 65% of secondary battery exports.

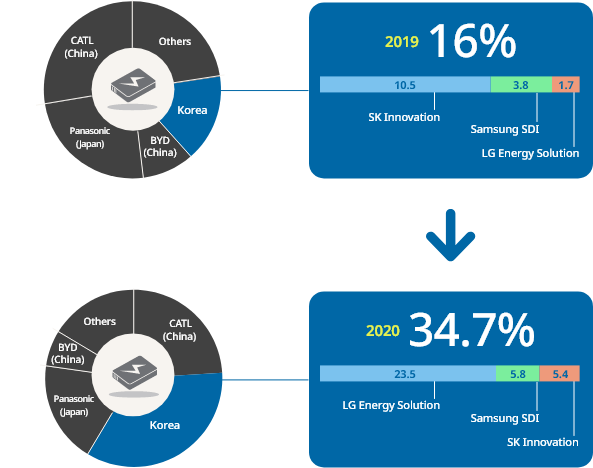

Korean firms’ market shares rise in the global EV battery market

Source: SNE Research (2020)

(Unit: %)

Korea’s major secondary battery makers -- LG Energy Solution, Samsung SDI and SK Innovation -- saw their market shares surge in the global EV battery market compared to the year-earlier period. In 2020, the three firms’ combined market shares stood at 34.7%, more than doubling their share from the previous year.

Three Korean battery makers’ combined market shares

EV & Energy Storage System (ESS) market growth expected to push demand for batteries

Secondary batteries are projected to see strong demand as upstream sectors, such as EV and ESS, continue to expand following the green initiatives launched in key markets such as in Europe, the US and China. In particular, the US is expected to firm up its energy policies under President Joe Biden’s new administration, such as rejoining the Paris Agreement and committing to carbon neutrality by 2050. Likewise, Europe is pushing for the same by 2050 and China has also announced plans to be carbon neutral by September, 2060. The growing secondary battery market is fueling competition over battery makers such as increased investments in facility expansion alongside the emergence of new market players. In the meantime, however, the top six companies from Korea, China and Japan are expected to take the lead.