-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Goldman Sachs zeros in on midmarket, ESG infrastructure deals

Private capital to supplement public spending for significant infra initiatives

By

Jun 03, 2021 (Gmt+09:00)

Goldman Sachs Asset Management focuses on middle-market, value-add strategy for infrastructure deals, targeting the sectors undergoing a digital transformation or a transition toward renewable energy.

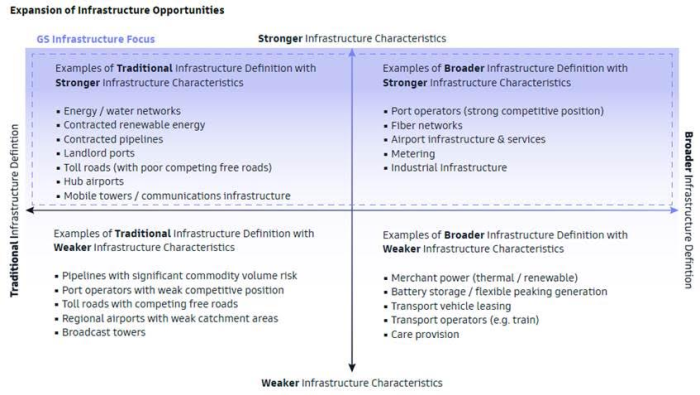

Infrastructure investment opportunities are expected to arise from a broader range of areas beyond public-private partnership projects, with the definition of infrastructure likely to be broadened to include segments such as battery storage, car leasing and care provision, said Scott Lebovitz, global co-head and co-chief investment officer of Goldman Sachs Infrastructure Group.

"The present economic climate is ripe for infrastructure investment and requires significant private capital," he said in a written interview with The Korea Economic Daily. "We believe the opportunity set is richest in mid-market and ESG-considered companies."

The following is the transcript of his remarks:

"As both the energy transition and digital trends in infrastructure accelerated, the pandemic-induced economic deterioration has resulted in many national, state, and local governments experiencing economic pressure."

"Nevertheless, many governments, including in the US and Europe, have recently announced significant public infrastructure initiatives. We believe that even with increased fiscal stimulus, the combination of aging public infrastructure and the new infrastructure requirements needed to support tomorrow’s economy will create vast opportunities for private capital to supplement — and in many cases drive —infrastructure development."

"The investment opportunity set beyond the immediate PPP programs is expected to be broad. Nascent sub-industries, greenfield projects, and ‘old-to-new’ transformation opportunities continue to be available to those with a depth of infrastructure and private equity investing experience."

"We believe the richest opportunity set resides in midmarket companies." Although many of these companies may not be perceived as “infrastructure” assets under a traditional definition, we believe they may ultimately hold the key “infrastructure characteristics” that make them tomorrow’s core infrastructure assets."

"The present economic climate is ripe for infrastructure investment and requires significant private capital. We believe the opportunity set is richest in mid-market and ESG-considered companies. That said, the owner of infrastructure assets, be it a private equity sponsor or a sovereign and state entity, will need deep domain expertise, especially in the emerging sub-sectors. They will also need a value-add, owner-operator approach in order to grow and develop an asset."

"Governments have a critically important role to play, as they encourage investment through the provision of political stability, supportive subsidies, and clear regulatory frameworks. Those that provide investor security in tandem with some fiscal support will attract significant private capital."

"In this environment, PPP should remain a viable funding model, but the return expectations for PPP will likely remain subdued as valuations remain elevated for most core assets. It should also be noted that Biden’s recently announced (spending) plan could displace some of the opportunities for core private capital in some sectors in the US."

"Perhaps most importantly, we believe we are at a rare point in time where both private and public capital can strategically reposition legacy assets, invest in the infrastructure assets of the future, all while having a deliberate focus on ESG and sustainable considerations."

Goldman Sachs Infrastructure Group has invested over $12 billion and has developed a team of tenured investors. It applies middle-market, value-add strategy with a focus on digital infrastructure, energy transition, transport and logistics and essential services since 2006.

In South Korea, its recent investments include a 24.95% stake in Korea Superfreeze Co., a cold storage facilities operator.

Scott joined Goldman Sachs in 1997 as an analyst in the investment banking division after graduating from the University of Virginia's school of commerce in the same year. He was promoted as managing director in 2007 and partner in 2012.

Write to Sang-eun Lucia Lee at selee@hankyung.com

Yeonhee Kim edited this article.

-

May 08, 2025 (Gmt+09:00)

-

May 02, 2025 (Gmt+09:00)

-

Apr 29, 2025 (Gmt+09:00)

-

Apr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)