-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

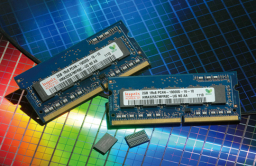

Memory chip supercycle cools as demand declines

DRAM demand for servers, laptops, smartphones to weaken

By

Jul 14, 2021 (Gmt+09:00)

A global memory chip supercycle is taking a breather with weakening growth in DRAM chip prices, halting bullish momentum in shares of Samsung Electronics Co. and SK Hynix Inc.

DRAM contract prices are expected to rise 3-8% in the third quarter from the previous three months, narrower than the 18-23% increase in the April-June period, industry research firm TrendForce said on July 13. That came as orders for server DRAM did not rise as much as expected, while demand for PCs and smartphones declined.

In server DRAM markets, Intel Corp. and Advanced Micro Devices Inc (AMD), the world’s top two makers of central processing units (CPUs), caused a bottleneck. It was known that delivery of some integrated circuits (ICs) takes 52-70 weeks as foundry chipmakers delayed output due to surging orders.

“IT companies, which had planned expansion of data centers, postponed construction due to IC supply shortages, slashing memory chip demand,” said an industry source. “The entire semiconductor industry is suffering from similar problems with troubles on Intel’s CPU production in 2018.”

Intel delayed a launch of the Sapphire Rapids, a next-generation CPU for servers, to next year from the initially planned second half of 2020. The delay caused expectations that year-end demand for server DRAM will be softer than earlier forecasts.

Price projections of various DRAM product categories

| 2Q 2021 | 3Q 2021 | |

| PC DRAM | up 23-28% | up 3-8% |

| Server DRAM | up 20-25% | up 5-10% |

| Mobile DRAM | up 8-13% | up 5-15% |

| Graphics DRAM | up 20-25% | up 8-13% |

| Total DRAM | up 18-23% | up 3-8% |

DEMAND FOR LAPTOPS, SMARTPHONES WEAK

DRAM Demand for PC and mobile devices is likely to slow as Taiwan’s original design manufacturers (ODMs) of laptops reported drops in revenue. Sales of top six ODMs fell 5% last month from a year earlier. Those ODMs are big DRAM buyers since they produce 70% of global laptops. Their sales are a barometer of global memory chip markets.

Declining demand from Chinese smartphone makers is expected to weigh on chips for mobile devices. Xiaomi and Honor, Huawei’s former budget smartphone unit, revised down smartphone output plans for this year by 10%. Samsung Electronics was also known to have trouble unveiling the Galaxy S21 FE due to tight supply of Qualcomm Snapdragon mobile platforms.

The memory chip boom cycle slowdown is expected to continue until the end of this year, analysts said.

“The fourth quarter will be in more trouble than the third as industry condition are worse than expected,” said Lee Seung-woo, an analyst at Eugene Investment & Securities. “But a long-term boom will stay intact as server demand is predicted to recover in the first half of next year.”

Write to Su-bin Lee at lsb@hankyung.com

Jongwoo Cheon edited this article.

-

Apr 30, 2021 (Gmt+09:00)

-

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2

Semiconductor shortagesMemory chip shortage may drive SSD price hike in Q2Mar 10, 2021 (Gmt+09:00)