-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

GS E&C secures €70 mn green loan from BNP Paribas for warehouses

Construction

GS E&C secures €70 mn green loan from BNP Paribas for warehouses

With four eco-friendly buildings, it has become the first Korean construction company to attract an ESG loan from Europe

By

Dec 17, 2021 (Gmt+09:00)

2

Min read

News+

The construction project is to develop, lease out and sell the warehouses, with a total floor area of about 185,000 square meters, some 13 kilometers southwest of Wroclaw. GS E&C started building the warehouses in May of this year and is targeting to complete them in 2023.

The warehouses use eco-friendly materials and have energy-saving factors, the company said. Two of the four warehouses have earned an "excellent" ESG rating, which is awarded to the top 10% of buildings, from the global sustainability assessment method Breeam. GS E&C has successfully attracted the loan based on the rating and is expecting to receive Breeam ratings for the other two warehouses, the company added.

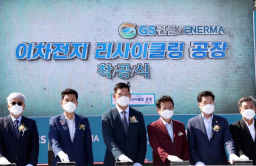

GS E&C is accelerating its ESG businesses in Korea as well. In September, the company started the construction of its first lithium-ion battery recycling plant in an industrial complex in Pohang, a southeastern port city of Korea, marking its entrance into the battery recycling business. The construction project followed the company’s agreement with Korean steelmaking giant POSCO to cooperate in lithium-ion battery recycling and the hydrogen business as well as set up a relevant joint venture. GS E&C said it will inject about 150 billion won ($126.4 million) in its first investment in the plant, which aims to start commercial production from 2023.

In July, the construction company signed a memorandum of understanding with the Pohang city government to build solar energy and hydrogen fuel cell energy plants in the same industrial complex. GS E&C pledged to invest a total of 500 billion won in the project from 2023 to 2028.

The company also received A, A+ and A ratings in various ESG criteria for Korean listed companies, ESG research institute Korea Corporate Governance Service announced in October.

Write to Yoojung Lee at yjlee@hankyung.com

Jihyun Kim edited this article.

More To Read

-

Sep 16, 2021 (Gmt+09:00)

-

Jul 23, 2021 (Gmt+09:00)

-

Renewable energyGS Energy to create renewable JV with Spain’s Iberdrola

Renewable energyGS Energy to create renewable JV with Spain’s IberdrolaJun 16, 2021 (Gmt+09:00)

-

Oct 22, 2020 (Gmt+09:00)