-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

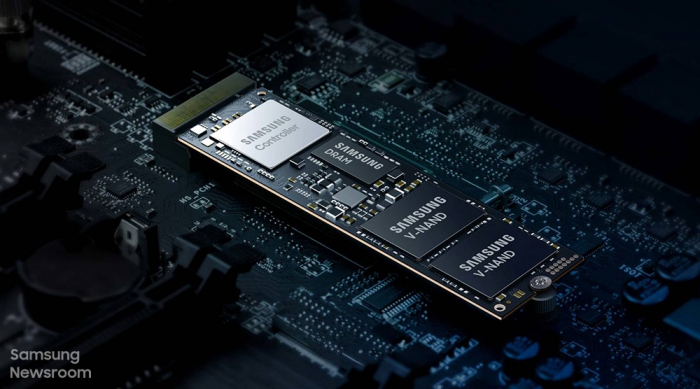

Samsung's Q4 operating profit jumps on server chips

It expects record revenue for 2021 on higher foundry chip prices and brisk sales of new foldable phones

By

Jan 07, 2022 (Gmt+09:00)

Samsung Electronics Co. on Friday reported a 52.5% jump in preliminary fourth-quarter operating profit from a year earlier, powered by replacement demand for server chips from big-name clients such as Microsoft Corp., Google Inc. and Amazon.com.

As the COVID-19 pandemic accelerates the shift to contactless services, the world's largest memory chipmaker is expected to enjoy growing demand for cloud servers and other chip-guzzling devices, alongside a rebound in memory chip prices expected to take place in the second half of this year.

Samsung estimated its fourth-quarter operating profit at 13.8 trillion won ($11.5 billion) on a consolidated basis, versus the previous year's 9.05 trillion won.

Sales were estimated to have risen 23.5% on-year to 76 trillion won ($63 billion) during the quarter.

The strong quarterly results also reflected foundry chip price hikes and brisk sales of the new foldable smartphones launched in August 2021, the Galaxy Z Fold3 and the Flip3, offsetting a fall in DRAM prices.

The PC DRAM spot price dropped 9.51% to an average of $3.71 in October from a month earlier, according to market tracker DRAMeXchange.

But with memory chips increasingly used for cloud servers and mobile gadgets, PC DRAM prices may no longer serve as an indicator of Samsung's semiconductor results, an industry source said.

Quarter on quarter, its operating profit declined 12.8% in the fourth quarter despite a 2.7% rise in sales, reflecting hefty year-end bonus payments to employees.

In the third quarter ended September 2021, the South Korean technology giant posted its highest operating profit in three years of 15.8 trillion won with record revenue of 74 trillion won.

RECORD ANNUAL SALES

For all of 2021, Samsung forecast its largest-ever revenue of 279 trillion won, up 18% from the previous year's 236.8 trillion won. Following the fourth-quarter earnings guidance, analysts revised upward their forecast for Samsung's 2022 sales to slightly above 300 trillion won.

The full-year operating profit of 51.6 trillion won in 2021 would mark its third-largest annual profit in history and the strongest results since 2018, when it earned 58.9 trillion won in operating profit, riding the semiconductor supercycle.

Analysts said the semiconductor division might account for 60% of the operating profit, or 29 trillion won, outweighing the estimated 14 trillion won from the IT & Mobile (IM) division.

Looking ahead, global tech giants such as Google, Amazon, Microsoft and IBM are predicted to purchase 23% more DRAM chips than they did in 2021, above Samsung's expected DRAM supply growth rate of 16% for this year, according to KB Securities.

IT & MOBILE DIVISION

The IM division was expected to have earned about 3 trillion won in operating profit in the fourth quarter on sales of 27 trillion-28 trillion won.

For all of 2021, the division's preliminary operating profit of 14 trillion won was its highest number since the 14.6 trillion won recorded in 2014. In terms of sales, the division made up about 40% of the company's annual results.

New additions to its high-end line of Galaxy Z Fold and Z Flip phones led the increase in its mobile phone sales. Samsung sold 8 million foldable phones last year, a fourfold rise from the previous year's shipment of 2 million units of the premium phones.

This year, it is planning to expand the lineup of low-end smartphones to target overseas markets.

Samsung Electronics' preliminary consolidated results:

| Q4, 2021 | Year-on-year | Quarter-on-quarter | |

| Operating profit | 13.8 trillion won | Up 52.5% | Down 12.8% |

| Sales | 76 trillion won | Up 23.5% | Up 2.73% |

| Source: Samsung Electronics | |||

Shares in Samsung Electronics closed up 1.82% at 78,300 won on Friday, slightly above a 1.18% rise in the broader Kospi market.

Late last month, its shares rebounded to a four-month high of 80,800 won on expectations that the memory chip downcycle would be coming to a close sooner than expected.

Meanwhile, LG Electronics Inc. said its fourth-quarter operating profit was estimated to have dropped 21% on-year to 681.6 billion won, battered by soaring raw material and logistics costs.

Sales at the world’s largest manufacturer of OLED TVs rose to its highest-ever 21 trillion won for the quarter ended December 2021.

(Updated with details and LG Electronics' fourth-quarter results near end.)

Write to Shin-Young Park at nyusos@hankyung.com

Yeonhee Kim edited this article.

-

Jan 06, 2022 (Gmt+09:00)

-

SemiconductorsTime to buy Korean chipmakers; Samsung among 2022 top picks

SemiconductorsTime to buy Korean chipmakers; Samsung among 2022 top picksJan 03, 2022 (Gmt+09:00)

-

Oct 08, 2021 (Gmt+09:00)