-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Orchestra PE acquires KFC Korea for about $50 mn

Mergers & Acquisitions

Orchestra PE acquires KFC Korea for about $50 mn

KFC Korea will shift to a franchise system from direct management by the US headquarters Yum!

By

Jan 12, 2023 (Gmt+09:00)

3

Min read

News+

Asia-focused Orchestra Private Equity agreed on Wednesday to buy a 100% stake in the South Korean operations of fast food chain KFC for around 60 billion won ($50 million), according to people with knowledge of the matter on Thursday.

Under the agreement, the private equity firm will acquire the whole ownership of KFC Korea, alongside its domestic business license from South Korea’s KG Group.

Aside from the deal, Orchestra PE signed a master franchise agreement with KFC’s parent group Yum! Brands to secure the rights to open franchise stores in South Korea.

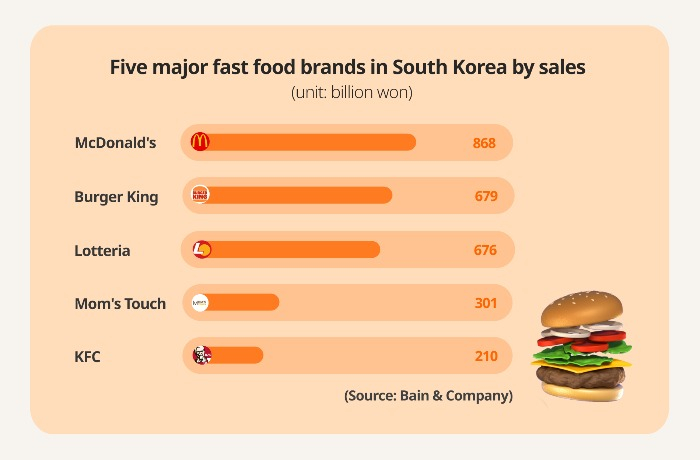

Despite its global brand awareness, KFC has been lagging homegrown Mom’s Touch and Burger King in the low-end and premium markets, respectively.

The fried chicken chain ranks fifth in South Korea’s fast food market by revenue after Lotteria, Burger King and McDonald’s. Its 2021 sales reached 210 billion won.

In terms of number of outlets, it is the fifth-largest player as well. Sector-leader Mom’s Touch runs 1,352 stores across the country, compared to KFC Korea’s 190.

Operating profit at KFC Korea plummeted to around 700 million won in 2020, or one-tenth of the 7 billion won it posted in 2014.

Its operating profit increased to 4.6 billion won in 2021 on sales of 210 billion won. But it fell into negative capital, with a debt-to-equity ratio of over 6,600%.

KFC Korea had been regarded as a tough sell in the domestic M&A market.

Coupled with its poor financial conditions, its Korean operations were required to fulfill the standards set by its US headquarters from menu selection to promotional and marketing activities.

Those requirements were the cause of conflicts with the US parent group.

In 2017, CVC Capital Partners sold KFC Korea to KG Group at 50 billion won, half the price that it paid to South Korea's Doosan Group three years before.

KG Group is now selling the fast food chain for around 60 billion won, slightly above its purchase price.

ADDITIONAL CAPITAL INJECTION

KFC Korea will be run as a franchise, or a separate entity, under a license agreement with Yum! Brands. It has been directly managed by the US parent group.

The deal will make South Korea the sixth country in which KFC’s local operations are managed under the franchise system, after the US, Canada, India and two other countries.

To improve KFC Korea’s financial conditions, Orchestra PE will inject an additional amount of money into the franchise by purchasing its new shares.

Yum! will invest in a project fund that Orchestra PE is launching to acquire KFC Korea as well. KPMG advised on the transaction.

Orchestra PE focuses on small and mid-market companies. It has been building a portfolio in South Korea, particularly in the food sector.

In November 2021, it purchased Banolim Food, operator of the homegrown Banolim Pizza, for around 60 billion won.

Last year, it acquired meal kit provider Jungsung Food for an undisclosed sum.

The acquisitions followed its exit from Majesty Golf in February of last year. It sold the premium golf club manufacturer to a consortium led by Seoul-based Striker Capital Management for 265 billion won.

The KFC Korea deal could give momentum to other fast food chains up for sale in the country.

Recently, Hong Kong-based Pacific Alliance Group joined the race to acquire the South Korean homegrown burger franchise Mom’s Touch & Co.

McDonald’s Corp. has put its South Korean operations up for sale, while Burger King’s operations in both South Korea and Japan were put on the block by Affinity Equity Partners.

South Korea’s fast food franchise market is forecast to grow to 4 trillion won by 2026 from 3.5 billion won in 2020, according to Bain & Company.

Write to Jun-Ho Cha at chacha@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Food & BeveragePAG joins race to buy Korean burger chain Mom's Touch

Food & BeveragePAG joins race to buy Korean burger chain Mom's TouchJan 11, 2023 (Gmt+09:00)

-

Nov 15, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsAffinity to send teaser for Burger King Korea, Japan sale

Mergers & AcquisitionsAffinity to send teaser for Burger King Korea, Japan saleJan 18, 2022 (Gmt+09:00)