-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Fintech firm Kakao Pay logs first yearly net profit in 2022

Earnings

Fintech firm Kakao Pay logs first yearly net profit in 2022

The digital wallet service provider's cash management boosted profit; operating loss increased to $36.2 million last year

By

Feb 08, 2023 (Gmt+09:00)

1

Min read

News+

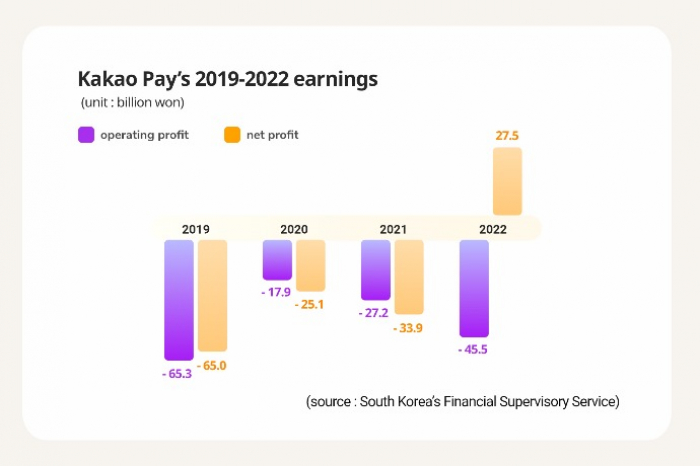

Kakao Pay Corp., the mobile payment service unit of South Korean tech giant Kakao Corp., posted a net profit last year for the first time since its inception in 2014. Operating loss, however, surged in the same period due to increased investment in subsidiaries.

The digital wallet company’s revenue on a consolidated basis rose 14% to 521.7 billion won ($414.8 million) last year, according to its 2022 earnings announced on Feb. 7. Its operating loss increased 67.4% to 45.5 billion won.

The firm’s net profit amounted to 27.5 billion won, thanks to increased income from the management of cash reserves.

The fourth-quarter revenue reached 122.9 billion won, falling 3.6% and 13% from the same quarter of 2021 and the third quarter of 2022, respectively. The fire at its data center and the disruption of its services last October impacted the quarterly revenue, Kakao Pay said.

The number of monthly active users on Kakao Pay rose 7% to 23 million won last year. The monthly transaction per user increased by 9.5% to 447,000 won.

Kakao Pay is expanding partnerships with China, Japan, Singapore, Macau, France and others that allow users offline payments in those countries, the company stated. It is also considering mergers and acquisitions with local companies to step up its payment systems and enhance profitability.

The company will launch a platform in May for users who want to borrow capital with lower rates to repay their existing loans with higher rates. It sees the demand rising as more borrowers mull refinancing these days due to interest rate hikes, Kakao pay said.

Write to Jin-Woo Park at jwp@hankyung.com

Jihyun Kim edited this article.

More To Read

-

Jan 20, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsKakao Pay seeks to acquire Loca Mobility up for sale by MBK Partners

Mergers & AcquisitionsKakao Pay seeks to acquire Loca Mobility up for sale by MBK PartnersDec 02, 2022 (Gmt+09:00)

-

Nov 04, 2021 (Gmt+09:00)

-

Apr 27, 2021 (Gmt+09:00)