-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

S.Korea’s jobs in February grow at slowest pace in 2 years

Asia’s fourth-largest economy faces the double whammy of an economic slowdown and a stagnant job market

By

Mar 16, 2023 (Gmt+09:00)

South Korea’s jobs grew at the slowest pace in two years last month partly owing to a slowdown in the country’s manufacturing sector due to dwindling semiconductor exports, adding to woes for Asia’s fourth-largest economy already grappling with stagnant growth.

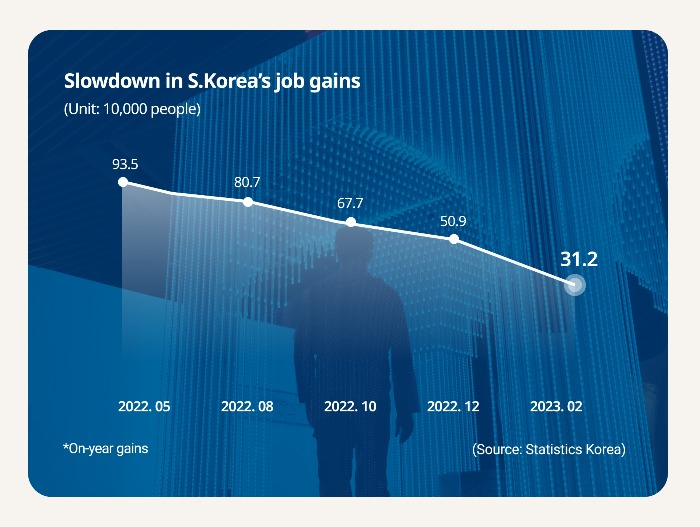

Korea added 312,000 new jobs, or 1.1%, in February from the same period a year earlier, the smallest gain since February 2021 when the country lost 473,000 jobs, according to data released from Statistics Korea on Wednesday. The number of employed people stood at 27,714,000.

The country added jobs for 24 months in a row but the rising pace has slowed for nine consecutive months since May last year when new jobs peaked at 935,000. The on-year gains last month also shrank to one-third of the jobs added a year ago.

The government attributed the slowdown in payroll gains to the high base effect of last year when the country significantly added jobs thanks to the economic reopening after three years of COVID-19 lockdowns.

But the job market was also hit by the economic slowdown and sluggish semiconductor demand, which shaved the country’s main growth driver exports.

Reflecting this, the country’s manufacturing sector lost jobs on-year for the second straight month last month. The sector saw payrolls down 27,000 in February, while the retail/wholesale and transportation sectors also lost 76,000 and 44,000 jobs, respectively.

Korea’s job growth last month was again driven by jobs taken by those in their 60s and above, with a 413,000 on-year gain. People in their 50s and 30s accounted for 77,000 and 24,000 of the total on-year gains, whereas those in their 20s and 40s lost 94,000 and 77,000, respectively.

Job losses for young people particularly accelerated last month. The employment for Koreans aged 15 to 29 fell by 125,000 from the prior year, the biggest loss since February 2021, with a loss of 142,000.

Their employment rate fell 0.4 percentage point on-year to 45.5%, while that for those aged 15 and above came to 68.0%, up 0.6 percentage point.

The country’s jobless rate stood at 3.1%, down 0.3 percentage point from a year ago but that for Koreans aged 15 to 29 ticked up 0.1 percentage point to 7.0% over the same period.

GLOOMY MACRO INDICATORS COMPLICATE FIGHT AGAINST INFLATION

The Korean government remains skeptical about any imminent recovery in the country’s job market. The finance ministry earlier projected the country would add about 100,000 new jobs in 2023 versus a gain of 816,000 in 2022.

The dismal job market outlook adds woes to the country’s already lackluster economy, complicating the rate path of the Bank of Korea that temporarily put a halt to its tightening move last month, leaving the country’s policy interest rate unchanged at 3.50%.

The Bank of Korea last month lowered its gross domestic product growth forecast for this year to 1.6% from its previous projection of 1.7%, which was already revised down in November 2022.

Bank of Korea Governor Rhee Chang-yong earlier this month said it is “premature to discuss a rate cut” despite growing risks of a recession in the country and the widening gap between the Korean rate and the US rate, which is poised to rise further, citing still-high inflation.

The wide rate gap between the US and Korea could accelerate capital flight from Korea as investors look for higher returns.

Korea’s inflation rose 4.8% in February from a year earlier, the slowest pace in 10 months, but the central bank needs to confirm it is falling to the low 3 percentage level by year-end before making a U-turn from its tightening moves, Rhee said.

The central bank’s inflation forecast was cut to 3.5% from the prior 3.6% last month.

Write to Eui-Jin Jeong at justjin@hankyung.com

Sookyung Seo edited this article.

-

Mar 02, 2023 (Gmt+09:00)

-

Feb 23, 2023 (Gmt+09:00)

-

Feb 21, 2023 (Gmt+09:00)

-

Feb 15, 2023 (Gmt+09:00)

-

Feb 13, 2023 (Gmt+09:00)

-

Nov 09, 2022 (Gmt+09:00)