-

KOSPI 2592.09 -1.58 -0.06%

-

KOSDAQ 715.98 -1.69 -0.24%

-

KOSPI200 345.28 +0.48 +0.14%

-

USD/KRW 1378 9.00 -0.65%

Friday May 23, 2025

ISS, Glass Lewis urge shareholders to veto activist fund's requests on JB

Shareholder activism

ISS, Glass Lewis urge shareholders to veto activist fund's requests on JB

The global proxy advisers recommend JB shareholders vote against Align’s request for higher dividends, outside director

By

Mar 17, 2023 (Gmt+09:00)

2

Min read

News+

Proxy advisers Institutional Shareholder Services Inc. (ISS) and Glass Lewis & Co. are urging shareholders of JB Financial Group Co., a South Korean holding company of local banks and other financial companies, to vote against proposals made by a domestic activist fund.

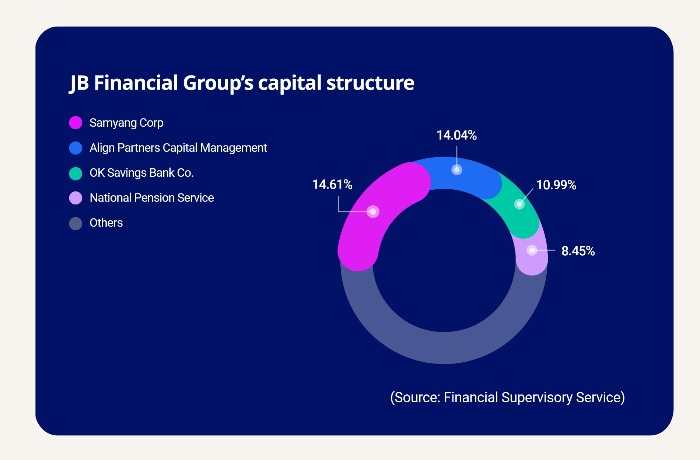

Align Partners Capital Management, the activist fund and the group’s second-largest shareholder with a 14.04% stake, proposed a dividend of 900 won ($0.7) per ordinary share, which JB refused, countering with an offer of a 715 won per-share dividend. The Korean PE firm also requested the appointment of Kim Ki-seok, former manager of Bank of America Securities Inc.’s Korea branch and managing partner at crowdfunding platform Crowdy Inc., as an outside director.

ISS advised shareholders to vote against both proposals at JB’s annual shareholder meeting on March 30, according to financial industry sources in Seoul on Thursday.

“It is likely to harm shareholders’ interest to demand an increase in dividends due to a lower dividend payout ratio than those of foreign banks,” ISS was quoted as saying by the sources in a move to support JB’s decision.

In January, Align made shareholder proposals such as higher dividends to seven listed financial holding companies -- KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group, BNK Financial Group Inc., DGB Financial Group and JB.

JB FINANCIAL FINDS SUPPORT

The activist shareholder requested that JB raise the ratio of its risk-weighted assets (RWA) to total assets less than the group’s plan to raise dividends. JB was slated to set the annual increase rate of the ratio at 7% to 8%, while the activist fund demanded 4% to 5%. A lower RWA ratio to total assets raises a bank’s common equity tier 1 (CET1), the highest quality of regulatory capital, allowing more dividend payouts.

JB refused the request, saying its net profit is expected to tumble, hurting its long-term growth if it lowers the increase rate to below 5%.

ISS said JB’s proposed target of 12% to 13% for CET1 and return on equity (ROE) is similar to those of other Korean financial holding companies.

“Align continued to complain to JB Financial while dropping shareholder proposals for the remaining six financial holding companies,” ISS said, according to the sources.

The proxy adviser urged JB shareholders to support outsider director candidates proposed by the group but to oppose Align’s nominee.

“There is no good justification for how the proposed candidate [by Align] will contribute to the board.”

Glass Lewis joined ISS’ move, industry sources said.

“The shareholder cannot replace the board’s judgment on financial strategy,” it was quoted as saying by the sources, referring to Align.

JB’s dividend payout ratio was estimated at 27%, compared with an average of 25.5% among the country’s four largest financial holding companies, KB, Shinhan, Hana and Woori, Glass Lewis said.

Write to Bo-Hyung Kim at kph21c@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

Shareholder activismJB Financial refuses activist fund's request to increase dividends

Shareholder activismJB Financial refuses activist fund's request to increase dividendsMar 03, 2023 (Gmt+09:00)

-

Jan 02, 2023 (Gmt+09:00)