-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

SK Ecoplant seeks to establish eco holding firm, sell 40% stake to PEFs

Corporate governance

SK Ecoplant seeks to establish eco holding firm, sell 40% stake to PEFs

The S.Korean company is in talks to sell about a 1 trillion won stake in its interim holding firm, estimated at up to 4 trillion won

By

May 30, 2023 (Gmt+09:00)

3

Min read

News+

SK Ecoplant Co. is seeking to establish an interim holding firm for its waste management subsidiaries and sell its stake to private equity firms as part of efforts to shore up its financial health, according to sources in the investment banking industry on Sunday.

The energy and engineering unit of South Korea’s No. 2 conglomerate SK Group is in separate negotiations with a few PEFs to sell about 40% of a new waste management holding firm to secure about 1 trillion won ($755 million), but nothing has yet been determined, the company said.

SK Ecoplant valued the interim waste management holding firm at 3 trillion to 4 trillion won, according to sources.

The new holding firm is expected to place SK Ecoplant’s 10 waste management businesses, including Environment Management Corp. (EMC), Samwon ENT, Daewon Green Energy, Saehan and E-Medione Industry, under its arms.

The latest move comes amid lingering concerns about SK Ecoplant’s financial soundness after its series of acquisitions of environment management companies since 2020 when it vowed to transform into an environmental company from an engineering company and changed its name from SK Engineering & Construction Co.

BALLOONED DEBTS

Under the new business roadmap, SK Ecoplant made inroads into the waste management market in the same year, with a purchase of Korea’s biggest waste treatment company EMC Holdings Co., currently EMC, for more than 1 trillion won from Affirma Capital.

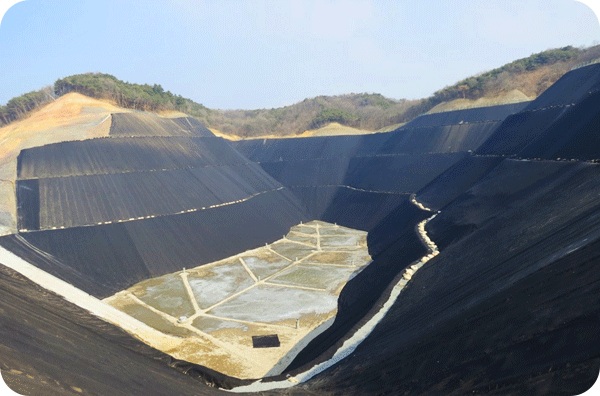

SK Ecoplant also spent about 2 trillion won in total to gobble up the aforementioned 10 local environmental businesses - mostly small- and mid-sized firms - in the water treatment and waste incineration sectors and the waste landfill industry since 2019.

In 2022, it made another major acquisition of Singapore-based electronic waste disposal and recycling company TES-Envirocorp Pte. Ltd. for $1 billion, expanding its waste treatment services beyond incineration and landfills.

The company’s aggressive M&As, however, elevated its debt-to-equity ratio to 432.1% in 2020 from 277.6% in 2019.

It lowered the debt ratio to 256% last year after selling its plant business and raising 1 trillion won in sales of redeemable convertible preference shares and convertible preference shares to PEFs on the condition of its public listing.

But major credit rating companies consider SK Ecoplant’s current debt ratio still high and its latest move an effort to further reduce its debt burden, not to restructure its governance structure.

A BUMPY ROAD AHEAD

It remains uncertain whether it could succeed in selling equity in the new interim holding firm to PEFs.

SK Ecoplant already received tepid interest from investors when it announced last year its plan to go public in the second half of 2023 at the earliest, with a corporate value of more than 10 trillion won.

It is urgent that the company first proves whether its environmental business subsidiaries are cash-generating businesses to persuade investors.

The combined earnings before interest, taxes, depreciation and amortization (EBITDA) of SK Ecoplant’s environment management units amounted to about 100 billion won as of end-2022, failing to convince that its environmental subsidiaries are creating synergy.

Its parent SK Group’s series of pre-IPO fundraising for other affiliates also bodes ill for SK Ecoplant’s latest capital raising effort, said market analysts.

Korea’s second-largest conglomerate has raised 7 trillion won from PEFs in pre-IPO share sales since 2019. Its battery-making unit SK On Co. earlier this year secured additional capital worth 1.2 trillion won from PEFs, while its drug contract development and manufacturing organization (CDMO) SK Pharmteco Co. is also seeking to raise 600 billion won.

SK Ecoplant may end up with a less than 1 trillion won investment from the holding firm’s equity sale because its major waste management unit EMC and its subsidiaries may not be able to join the sale.

When it borrowed money from financial institutions to buy EMC in 2020, it signed an agreement with its seven lenders to discuss with them any change in its governance structure.

But it came away empty-handed from earlier talks with its lenders, according to sources.

SK Ecoplant is said to be reviewing an option to merge EMC with the interim holding firm after 2025 when its loan agreement with the lenders expires.

Write to Ji-Eun Ha and Jun-Ho Cha at hazzys@hankyung.com

Sookyung Seo edited this article.

More To Read

-

May 17, 2023 (Gmt+09:00)

-

Carbon neutralitySK Ecoplant aims to cut CO2 emissions from fuel cell power generation

Carbon neutralitySK Ecoplant aims to cut CO2 emissions from fuel cell power generationApr 24, 2023 (Gmt+09:00)

-

Mar 10, 2023 (Gmt+09:00)

-

Feb 28, 2023 (Gmt+09:00)

-

Mar 21, 2022 (Gmt+09:00)

-

Feb 28, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsSK Ecoplant buys e-waste recycling firm for $1 bn

Mergers & AcquisitionsSK Ecoplant buys e-waste recycling firm for $1 bnFeb 21, 2022 (Gmt+09:00)