-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Foreign buying of Korean stocks, bonds at record high, boosting won

Foreign exchange

Foreign buying of Korean stocks, bonds at record high, boosting won

The move comes as the Korean government is taking a series of measures to ease regulations to attract foreign investors

By

Jun 13, 2023 (Gmt+09:00)

2

Min read

News+

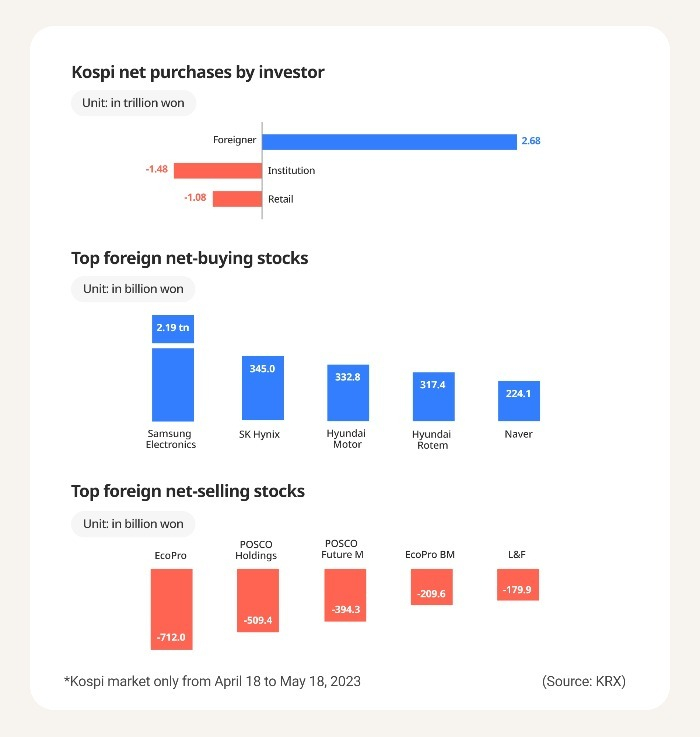

Foreigners bought a record $11.43 billion in South Korean stocks and bonds in May, boosting the value of the won versus the dollar amid the greenback’s broader gains against major currencies globally.

The foreign purchase of Korean securities is over three times their buying worth $3.25 billion the month prior and double their net buying of $5.6 billion for the entire 2022, Bank of Korea data showed on Monday.

Foreign investors bought Korean stocks worth $2.48 billion last month, up from $910 million in April. Bond purchases reached $8.96 billion, up from $2.33 billion.

“Although the dollar remains strong versus most major currencies, foreigners heavily bought into the Korean market, underscoring their high expectations for a recovery in the global chip industry,” said a BOK official.

Korea’s main stock index, Kospi, finished at a one-year high of 2,595.87 on the last day of May as foreigners gobbled up chip and electronics shares such as Samsung Electronics Co., SK Hynix Inc. and LG Electronics Inc.

In early Tuesday trade in Seoul, the Kospi was up 0.5% at 2,643.11.

WON GAINS STAND OUT

The Korean currency has performed relatively well compared with other currencies, which largely fell against the dollar.

The value of the won rose 2.6% from the end of May to June 8. By contrast, the US dollar index, which measures the greenback’s movement relative to a basket of six major currencies – the euro, the Japanese yen, the British pound, the Canadian dollar, the Swedish krona and the Swiss franc – advanced 1.7% over the same period.

Against the dollar, the euro fell 2.2%, the yen declined 1.9% and the Chinese yuan retreated 3% in the cited period.

On Monday, the won strengthened to 1,288.3 against the dollar, the highest since mid-March, and firming from 1,337.7 at the end of April.

Meanwhile, the Korean government recently announced a series of measures to attract foreign investors while easing restrictive regulations.

The finance ministry said it plans to allow foreign investors to directly convert their foreign currency funds for investment in domestic securities without any requirement to pre-deposit in the country.

Earlier this year, the ministry also said it will abolish the pre-registration system for foreigners to invest in local stocks.

Write to Jin-Gyu Kang at josep@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Foreign exchangeS.Korea to ease regulations for foreign investor in domestic market

Foreign exchangeS.Korea to ease regulations for foreign investor in domestic marketJun 08, 2023 (Gmt+09:00)

-

Korean stock marketKorean investors’ risky bet: Buy inverse ETFs as Kospi heads higher

Korean stock marketKorean investors’ risky bet: Buy inverse ETFs as Kospi heads higherJun 05, 2023 (Gmt+09:00)

-

Korean stock marketForeign demand for chip stocks powers Kospi to 1-year high

Korean stock marketForeign demand for chip stocks powers Kospi to 1-year highMay 30, 2023 (Gmt+09:00)

-

Korean stock marketForeigners gobble up chip stocks in S.Korea, buoying overall Kospi

Korean stock marketForeigners gobble up chip stocks in S.Korea, buoying overall KospiMay 19, 2023 (Gmt+09:00)

-

Business & PoliticsS.Korea to offer subsidies to foreigners investing in advanced technologies

Business & PoliticsS.Korea to offer subsidies to foreigners investing in advanced technologiesApr 26, 2023 (Gmt+09:00)

-

Mar 17, 2023 (Gmt+09:00)