-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Samsung to make Tesla’s fifth-generation HW 5.0 auto chip

Korean chipmakers

Samsung to make Tesla’s fifth-generation HW 5.0 auto chip

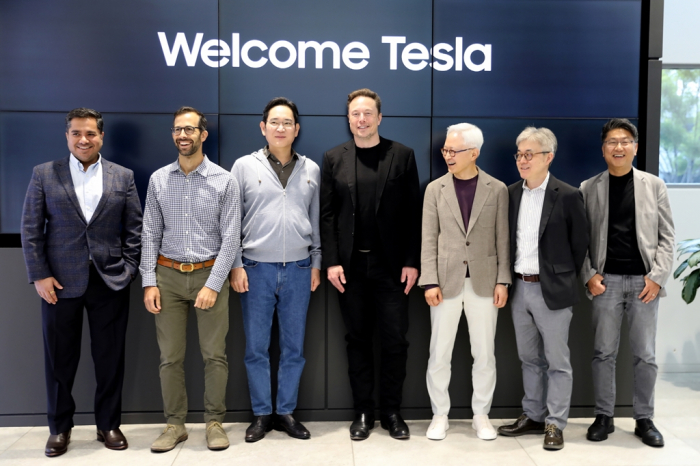

Following Samsung leader Lee’s meeting with Musk in May, Tesla is strengthening its partnership with the Korean chipmaker

By

Jul 18, 2023 (Gmt+09:00)

3

Min read

News+

Samsung Electronics Co., the world’s largest memory chipmaker, will make Tesla Inc.’s next-generation Full Self-Driving (FSD) chips to be used in the top US electric carmaker’s Level-5 autonomous driving vehicles.

The chips, to be manufactured on Samsung’s 4-nanometer node, will go into Tesla’s Hardware 5 (HW 5.0) computers, which the EV maker plans to mass-produce three to four years from now, industry officials said on Tuesday.

Last year, Tesla chose Taiwan Semiconductor Manufacturing Co. (TSMC) as its sole partner for the production of the HW 5.0 auto chip.

Now, Tesla plans to work with both TSMC and Samsung, or could switch from TSMC to Samsung altogether, for mass production of the fifth-generation auto chips, industry officials said.

“Splitting next-generation chip production between the two is more likely though,” said one of the officials.

WINDS OF CHANGE

The winds of change started in May when Samsung Group leader Lee Jay-yong met with Tesla Chief Executive Elon Musk to discuss ways to strengthen their tech alliance.

During their meeting at a Samsung research center in Silicon Valley, San Jose, the Samsung chairman, widely known in international business circles as Jay Y. Lee, offered Musk terms including favorable contract prices that he could not refuse, industry officials said.

Samsung officials earlier said the Lee-Musk meeting focused on strengthening their technology partnership, including jointly developing chips for fully autonomous vehicles.

Samsung had been supplying earlier versions of FSD chips to Tesla for EVs such as the Model 3, Model 5, Model X and Model Y.

Samsung’s foundry business sales proportions

*2022 sales

(Source: Samsung Electronics)

As its next-generation FSD chip vendor, however, Tesla picked TSMC over Samsung last year as the Korean chipmaker was thought to be behind the Taiwanese company in foundry chip manufacturing yields at the cutting-edge 4 nm process node.

Industry watchers said Samsung has since improved its foundry yields, now nearly on par with those of TSMC.

Last week, HI Investment & Securities analyst Park Sang-wook said in a research note that Samsung’s chip production yield rates for the 4 nm and finer 3 nm nodes have improved to over 75% and 60%, respectively.

Although Samsung is the world’s top memory vendor, it is a distant second in contract manufacturing, with a low double-digit market share. TSMC controls more than half the global foundry market.

BIG BETS ON AUTO CHIPS

Samsung fiercely competes with TSMC to win automotive chip supply deals from EV makers, including Tesla.

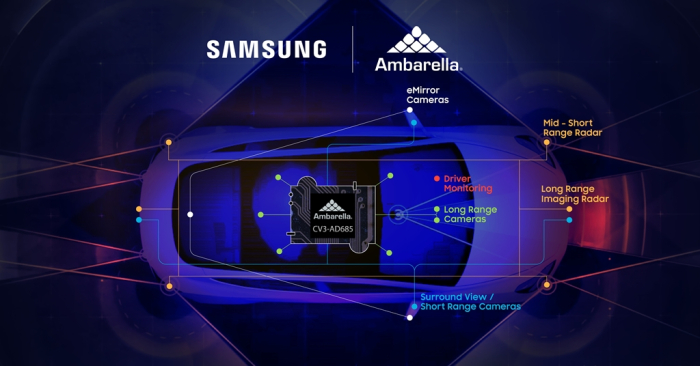

In February, it clinched a deal to make auto chips for US chip designer Ambarella Inc.

Under the deal, Samsung Foundry, the Korean chipmaker’s contract chipmaking unit, will manufacture Ambarella’s CV3-AD685 chip, which processes data for autonomous driving from Level 2 to Level 4.

In April, the Korean company won a chip production order from Intel Corp.’s autonomous driving tech affiliate Mobileye Global Inc.

The chipmaker will provide Mobileye with semiconductors for advanced driver assistance systems (ADAS), key devices for self-driving cars. Mobileye previously secured such chips from TSMC.

Samsung plans to significantly increase its foundry capacity at its main Pyeongtack plant in Korea this year and begin operations at its Taylor, Texas plant by the end of 2024 to triple the company’s 2022 global contract chipmaking capacity by 2027.

It has been solidifying its high-tech chip lineup as global carmakers are rapidly adopting autonomous and in-vehicle infotainment systems, which has upped the demand for advanced auto chips.

According to market researcher IHS Markit, the global auto chip market is forecast to grow to $143 billion by 2029 from this year’s estimated $76 billion.

Write to Jeong-Soo Hwang, Ik-Hwan Kim and Ye-Rin Choi at hjs@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analyst

Korean chipmakersSamsung improves 4 nm foundry yields, on par with TSMC: analystJul 11, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMC

Korean chipmakersSamsung on smooth track to 1.4 nm foundry tech to take on TSMCJun 28, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung takes on TSMC with strengthened chip design IPs

Korean chipmakersSamsung takes on TSMC with strengthened chip design IPsJun 14, 2023 (Gmt+09:00)

-

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech alliance

Business & PoliticsSamsung’s Jay Y. Lee, Tesla’s Elon Musk discuss tech allianceMay 14, 2023 (Gmt+09:00)

-

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other imports

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other importsFeb 03, 2023 (Gmt+09:00)

-

Business & PoliticsTesla’s Musk names Korea among top candidate sites for Gigafactory

Business & PoliticsTesla’s Musk names Korea among top candidate sites for GigafactoryNov 23, 2022 (Gmt+09:00)