-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Kombucha tea brands lure investors as diet drink market grows

Food & Beverage

Kombucha tea brands lure investors as diet drink market grows

The global kombucha tea market is forecast to swell to $11.4 billion by 2030, versus $2.5 billion in 2021

By

Aug 11, 2023 (Gmt+09:00)

3

Min read

News+

South Korea’s medium-sized electronics components maker Phoenix Rising PTE Ltd. has agreed to invest 3 billion won ($2.3 million) in domestic kombucha tea company Added Biome Co. to become the latter’s second-largest shareholder, according to the companies.

Phoenix Rising signed a memorandum of understanding on Aug. 9 to secure a 23% stake in Added Biome.

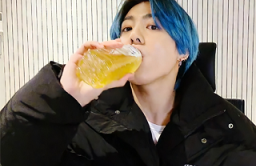

Added Biome attracted the investment in Series A funding as kombucha, a fermented black tea, is gaining popularity as a health and diet drink among young people, even including BTS member JungKook.

“We’ll grow our corporate value with a goal of going public,” Added Biome Chief Executive Choi Jung-hui said in a statement.

Other Korean food and beverage groups such as CJ Group are looking to jump into the growing market, which is forecast to swell to $11.4 billion by 2030 globally versus $2.5 billion in 2021, according to Polaris Market Research.

Added Biome is one of the country’s three leading kombucha companies, along with Teazen Co. and Freshico Inc.

The two other startups raised funding from outside investors last year. Market watchers said their investors would exit at the time of their stock market listing.

It sells kombucha at Costco’s South Korean outlets and E-Mart Inc., as well as small to medium-sized coffee chains, including Mega Coffee and Ediya Coffee. It was recently chosen as a tea supplier for Korean Air Lines Co.'s prestige class in-flight meal service.

Phoenix Rising expects the investment in the kombucha startup to diversify its portfolio from business-to-business transactions to business-to-consumer services.

It manufactures pads, film and tapes for batteries, displays and mobile devices with some 10 subsidiaries. LK Celltech is its core unit with an annual revenue of 120 billion won.

Its Australia-based energy storage system developer AVO Power is preparing to list on Australia’s stock market at a valuation of about 200 billion won.

The investment from Phoenix Rising will be used to expand Added Biome’s distribution network.

It also sells the sour and sweet-tasted tea at CJ Olive Young Corp., the country’s largest beauty product chain under CJ Group, as well as at H Mart, a Korean food supermarket chain in the US.

It is slated to add tea to the list of meals served by Samsung Welstory, a catering company.

Added Biome’s financial results were not disclosed.

Teazen is South Korea’s largest kombucha company. It saw its sales skyrocketing after BTS member JungKook revealed he was a regular drinker of Teazen’s kombucha in 2021.

Teazen, a compound word of “tea” and “zen,” was established in 2001 by its current CEO Kim Jong-tae, who had led the launch of the country’s largest tea brand Osulloc, while working at Amorepacific Corp.

In 2022, Seoul-based private equity house VIG Partners acquired a majority stake in Teazen for around 80 billion won at an enterprise value of 100 billion won. The valuation is about eightfold of Added Biome’s 13 billion won estimated by Phoenix Rising.

Last year, Teazen earned 10.2 billion won in operating profit on revenue of 58 billion won.

Another leading kombucha supplier Freshico Inc. was merged in 2022 into HLB Global, a retail unit of the biotech conglomerate HLB Group, led by Chairman Jin Yang-gon.

Freshico posted 26.9 billion won in revenue in 2022., led by its flagship brand “I’m Alive Kombucha.”

Kombucha is expected to expand its share in the beverage market as a diet drink, along such products as zero-calorie sodas.

Write to Dong-Hui Park at donghuip@hankyung.com

Yeonhee Kim edited this article

More To Read

-

Food & BeverageBTS-loved kombucha brand Teazen up for sale

Food & BeverageBTS-loved kombucha brand Teazen up for saleApr 29, 2021 (Gmt+09:00)