-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korean firms fret over growing adoption of Chinese LFP batteries

Batteries

Korean firms fret over growing adoption of Chinese LFP batteries

Cornered by the growing influence of CATL and BYD, the Korean battery trio is also developing LFP batteries

By

Aug 28, 2023 (Gmt+09:00)

4

Min read

News+

South Korea’s three major battery makers – LG Energy Solution Ltd., SK On Co. and Samsung SDI CO. – are increasingly anxious about electric vehicle makers' growing adoption of lithium iron phosphate (LFP) batteries mostly made by Chinese companies.

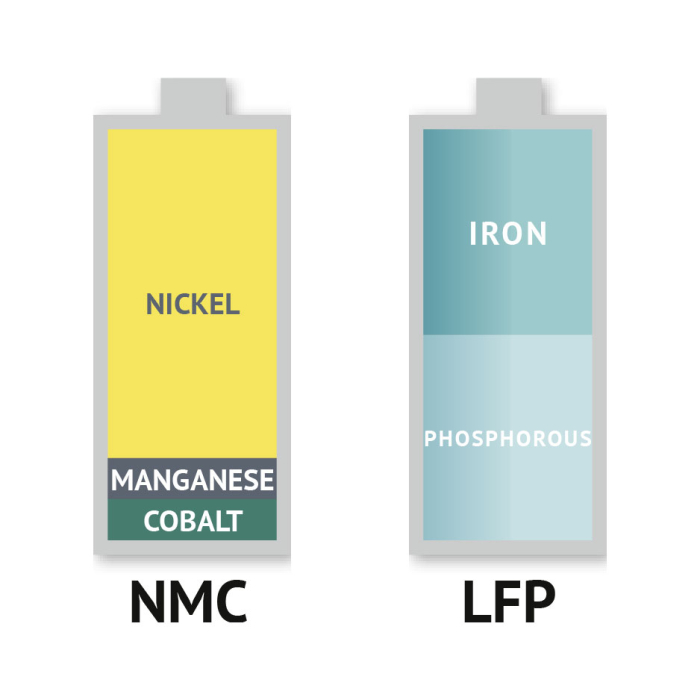

The Korean battery trio, which mainly produces nickel-cobalt-manganese (NCM) batteries, is witnessing a fast rise in demand for the rival LFP type that is particularly popular among low-end, entry-level electric cars.

During the Chengdu Motor Show last Friday, Kia showcased the EV5, its first China-made all-electric vehicle that the company plans to sell globally.

The model to be manufactured by the Kia-Yueda joint venture at their Yancheng plant will be equipped with BYD Co.'s LFP batteries.

Kia has used batteries made by Korean battery makers for its EV models.

Ford Motor Co.’s new Lincoln Nautilus SUV, unveiled at the Chengdu Motor Show, will also be fitted with BYD batteries, but not the LFP type. It will use NCM batteries.

Kia and Ford, which will produce their latest models in China, are joining other global EV makers, including Tesla Inc. and Toyota Motor Co., which are increasingly adopting Chinese batteries, notably the LFP type.

By forging partnerships with BYD, global EV makers aim to cut production costs as well as make it easier for them to enhance their presence in China, the world’s largest EV market, analysts said.

TESLA, MERCEDES-BENZ, HYUNDAI USE CATL BATTERIES

Tesla, which depends on China’s Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, for most of its electric cars, has also started using BYD’s LFP batteries in some versions of the Model 3 and Model Y.

Other EV models that use CATL batteries include Mercedes-Benz's EQS, MG Group's electric vehicles ZS and MG-4, and Hyundai Motor Co.’s Kona EV.

BYD has supplied its batteries to the joint venture of Toyota and China’s FAW Group Corp. for the JV’s compact bZ3 electric Corrola. Ford’s China-made Evos is also expected to use a BYD battery.

LFP cells are lower in energy density but cheaper to make compared to other types such as NCM batteries. LFP batteries are also more stable, meaning less vulnerable to fire.

China’s authorities are fostering its LFP battery industry, providing subsidies for technology development and raw material procurement.

In October 2021, Tesla said it plans to install LFP batteries in all of its standard-range EVs.

Other global automakers followed suit with Volkswagen AG and Daimler AG set to use LFP cells for their entry-level EVs this year and in 2024, respectively.

KOREAN SUPPLIERS FEEL CORNERED

The growing adoption of Chinese batteries has hit Korean producers, slashing their global market shares.

According to market researcher SNE Research, CATL and BYD were the two largest battery suppliers, accounting for 36.8% and 15.7%, respectively, of the global battery market in the first half.

From the year-earlier period, CATL’s battery usage rose 56.2% to 112 GWh while that of BYD more than doubled to 47.7 GWh.

By comparison, the three Korean battery suppliers’ combined market share fell 2.2 percentage points year on year to 23.9% in the first half.

Seoul-based Eugene Investment & Securities expects the adoption of LFP batteries by passenger EV sedans worldwide to rise above 30% this year from 7% in 2018.

CHINA’S TECHNOLOGICAL EDGE OVER KOREA

Analysts said EV makers are increasingly adopting Chinese batteries as Chinese suppliers are advancing technology faster than their Korean rivals.

“Some people say Korean companies are ahead of CATL in technology advancement. But that is not correct. Korean battery makers must hurry to catch up with Chinese companies if they don’t want to get left behind,” said a Korean battery maker executive.

In mid-August, CATL launched Shenxing, a superfast charging LFP battery, capable of delivering a driving range of 400 km on a 10-minute charge and a range of over 700 km on a single full charge.

KOREAN FIRMS JOIN LFP RACE

With the growing popularity of LFP batteries, Korean companies have also joined the race for the cheaper version of battery cells.

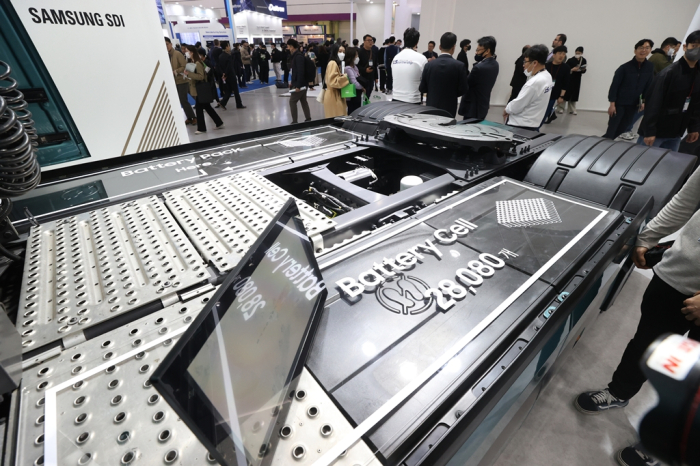

The Korean trio unveiled prototypes of LFP batteries at InterBattery 2023, the country’s largest battery show, earlier this year.

LG Energy has switched part of its energy story system (ESS) production lines at its plant in Nanjing, China to produce LFP batteries with a plan to begin mass production in 2025.

Samsung SDI is considering building an LFP battery plant in Ulsan, southeast of Seoul.

SK On, which showed its prototype of LFP batteries in March, said it will spend 470 billion won ($352 million) to begin mass production in 2028 of solid-state batteries, which last longer and charge faster than standard lithium-ion batteries.

A unit of Korea’s top oil refiner SK Innovation Co., SK On plans to build a new pilot line for LF batteries in Korea by the end of 2024.

Write to Sungsu Bae and Il-Gue Kim at baebae@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Electric vehiclesKia unveils design of EV5, its first China-made global electric car

Electric vehiclesKia unveils design of EV5, its first China-made global electric carAug 25, 2023 (Gmt+09:00)

-

Jul 11, 2023 (Gmt+09:00)

-

Apr 24, 2023 (Gmt+09:00)

-

Mar 16, 2023 (Gmt+09:00)

-

Mar 09, 2023 (Gmt+09:00)

-

Apr 04, 2022 (Gmt+09:00)

-

Oct 22, 2021 (Gmt+09:00)