-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

SK, Lotte cut copper foil output; to up Malaysia capacity

Batteries

SK, Lotte cut copper foil output; to up Malaysia capacity

Their production capacity in Malaysia is forecast to outstrip domestic output

By

Nov 27, 2023 (Gmt+09:00)

2

Min read

News+

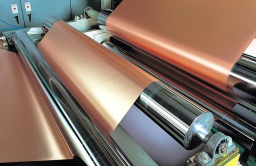

SK Nexilis Co. and Lotte Energy Materials Corp., South Korea’s two leading copper foil producers, have continued to reduce factory operation rates amid fierce price competition and oversupply concerns due to slowing electric vehicle demand.

However, they are expanding capacity in Malaysia to cut the manufacturing costs of copper foil, an essential material of EV batteries and prepare for a medium to long-term demand recovery.

The factory operation rate at SK Nexilis, a subsidiary of chemical materials maker SKC Ltd., declined to 61.6% in the third quarter of this year, compared to 67% in the first half of this year and 88.1% in all of 2022, according to industry officials on Sunday.

It is the world’s largest copper foil maker.

Lotte Energy Materials Co. saw its factory operation rate sharply drop to 59.5% in the third quarter of this year, versus 89.5% in all of 2022.

The two companies forecast copper foil to be in oversupply through 2025.

Cooper foil factory operation rate

Unit: %

2022 2023

Note: The 2023 figures are as of the end of September

Sources: SK Nexilis, Lotte Energy Materials

A domestic copper foil company official said its plant operation rate has tumbled to below half and reduced the working hours of factory workers to three times a week.

SK and Lotte ship their products mainly to the US market and is competing head-to-head with China's Wason Copper Foil and Jiujiang Defu Technology, as well as Taiwan's Chang Chun.

Given their narrow technology gap in the copper foil industry and overlapping customers, factory operation rates at the foreign rivals seemed to have dropped as well, industry observers said.

SK Inc. owns a 30% stake in the parent company of Wason Copper Foil.

Jiujiang Defu Technology forecast in a recent conference in Nanjing that the copper foil supply in China will remain in oversupply over the next five to eight years.

CAPACITY EXPANSION IN MALAYSIA

However, SK Nexilis and Lotte Energy Materials are seeking to expand production mainly through its Malaysian operations in the medium to longer-term

Electricity costs account for about 15% of the cost of manufacturing copper foil, and electricity costs in Malaysia are about 50% cheaper than those of South Korea.

SK Nexilis launched commercial production at its first overseas factory in Malaysia last month. The new facility boasts the world's largest production lines of copper foil.

It is one of the twin plants SK Nexilis has been building in the Southeast Asian country.

Lotte Energy has been expanding its capacity in Malaysia as well, with two new production facilities scheduled for completion in the first half of next year.

Amid worsening market conditions, SK Nexilis filed a lawsuit against Solus Advanced Materials Co., a domestic copper foil company, and Volta Energy Solus, its overseas subsidiary, in the Eastern District Court of Texas on Nov. 21.

It argued that Solus and its subsidiary infringed on four of its patents, including core technologies to control the physical and surface properties of copper foil.

Solus was not immediately reachable for comment.

Write to Kyung-Kyu Kim and Mi-Sun Kang at khk@hankyung.com

Yeonhee Kim edited this article

More To Read

-

Nov 05, 2023 (Gmt+09:00)

-

Jul 04, 2023 (Gmt+09:00)

-

Sep 17, 2023 (Gmt+09:00)

-

Sep 06, 2023 (Gmt+09:00)

-

Sep 05, 2023 (Gmt+09:00)

-

Mergers & AcquisitionsSK eyes $1 bn gains from Chinese copper foil firm exit

Mergers & AcquisitionsSK eyes $1 bn gains from Chinese copper foil firm exitAug 31, 2023 (Gmt+09:00)

-

Aug 10, 2023 (Gmt+09:00)

-

Feb 19, 2023 (Gmt+09:00)

-

Private equityKorean PE firm STIC to buy stake in copper foil maker Iljin

Private equityKorean PE firm STIC to buy stake in copper foil maker IljinFeb 15, 2023 (Gmt+09:00)

-

Aug 03, 2022 (Gmt+09:00)

-

Jul 08, 2022 (Gmt+09:00)