-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Hyundai Mobis eyes strong overseas orders again in 2024

Automobiles

Hyundai Mobis eyes strong overseas orders again in 2024

The world’s No. 6 auto parts maker won a record $9.2 billion in overseas orders in 2023, nearly doubling the year previous

By

Jan 29, 2024 (Gmt+09:00)

3

Min read

News+

Hyundai Mobis Co., the world’s sixth-largest automotive parts maker, known as Mobis outside of its home South Korea, expects another strong year for overseas sales this year after recording its highest-ever international orders last year on brisk sales of electrification parts and components.

The Korean automotive car parts maker said on Monday that its total parts and component orders from foreign automakers hit a new record of $9.2 billion in 2023, nearly doubling the year previous when it also won record-high foreign orders.

The last year’s offshore sales were also 72% higher than its initial target of $5.4 billion.

The company largely attributed the stellar performance to its contract purportedly worth billions of dollars with Volkswagen AG to supply its battery system assembly (BSA), a core EV component, to be used in the German auto giant’s next-generation platform for its clean vehicles.

It has set a target to reap $9.3 billion in overseas sales in 2024 by focusing on deliveries of core electrification parts, automotive electric and electronics devices, lamps and chassis.

Its mainstay parts are augmented reality head-up displays (AR-HUDs), advanced driver assistance systems (ADAS), real wheel steering systems (RWS) and rollable displays.

Hyundai Mobis’ orders from overseas finished carmakers

Unit: Billion US$

Source: Hyundai Mobis

The BSA is a combined system of a battery pack, the battery management system (BMS) and other components and is essential in ensuring the safe and efficient operation of EV batteries.

Hyundai Mobis’s BSA can be used for all eco-friendly vehicles, including all-electric vehicles and hybrid cars.

Another multinational automaker Stellantis N.V. is also said to have placed orders for Hyundai Mobis’ BSAs.

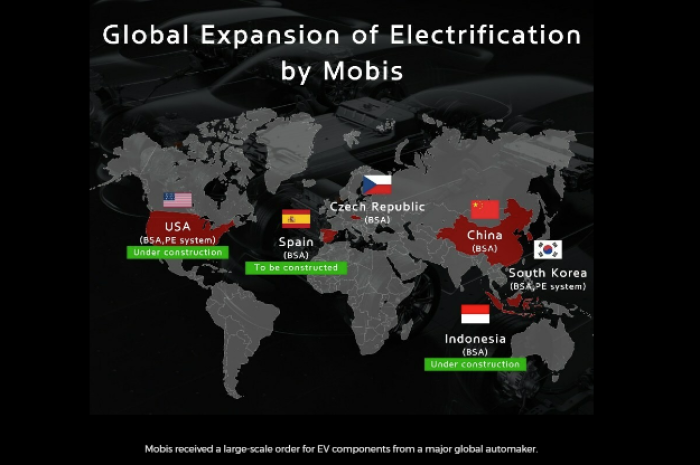

To meet growing demand from abroad, the Korean auto parts major is building BSA parts plants abroad.

It plans to build a plant near the Volkswagen factory in Spain to ensure prompt deliveries of BSAs, while it is building two other BSA plants in the US and Indonesia, respectively.

The Korean auto parts major is currently operating BSA plants in China, the Czech Republic and South Korea.

Once the new factories abroad are completed, Hyundai Mobis is expected to win more orders from foreign clean car makers.

In September last year, the company announced it would achieve an average annual sales growth of 30% in Europe through 2030 on the back of solid demand for its core electrification components.

The company plans to spend more to diversify its order portfolio with next-generation technologies, it said on Monday.

It spent 1.6 trillion won ($1.2 billion) on research and development (R&D) in 2023, about 20% higher than its R&D cost in 2022.

STANDING ALONE

The affiliate of Hyundai Motor Co. and Kia Corp. has been enhancing its electrification competitiveness since it opened a green car parts-dedicated plant in Korea in 2013. It is now a powerhouse of EV parts and components.

To expand its presence outside of Korea with its technology leadership, Hyundai Mobis has decided to reduce its reliance on its sister companies Hyundai Motor and Kia.

Its sales to the automaking affiliates account for more than 70%, and it has set a goal to push the rate down to 60% in the longer term.

As part of such efforts, it stopped using “Hyundai” in its name in overseas markets. It was known that its car-making siblings’ foreign competitors had been reluctant to place parts and component orders with their rivals’ affiliate.

Such efforts have paid off. It started supplying key modules for Mercedes-Benz AG’s EVs produced in the US in 2022. BMW, General Motors Co. and BYD Co. are also its customers.

Thanks to the brisk foreign sales, Hyundai Mobis raked in 2.3 trillion won in operating profit in 2023, up 13.3% from the previous year.

Its net income jumped 37.6% to 3.4 trillion won on a record sales of 59.3 trillion won, up 14.2%.

Write to Nan-Sae Bin at binthere@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Jan 26, 2024 (Gmt+09:00)

-

Dec 28, 2023 (Gmt+09:00)

-

Nov 30, 2023 (Gmt+09:00)

-

Electric vehiclesHyundai Mobis eyes over 30% growth in Europe through 2030

Electric vehiclesHyundai Mobis eyes over 30% growth in Europe through 2030Sep 05, 2023 (Gmt+09:00)

-

Electric vehiclesHyundai Mobis wins EV component supply deal from VW

Electric vehiclesHyundai Mobis wins EV component supply deal from VWAug 09, 2023 (Gmt+09:00)

-

Jun 27, 2023 (Gmt+09:00)

-

Apr 28, 2023 (Gmt+09:00)