-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

NPS logs record return rate in 2023 on stocks’ bull run

Pension funds

NPS logs record return rate in 2023 on stocks’ bull run

It will introduce a new system for asset allocation, benchmarking CalPERS and CPPI; pension reform is still under discussion

By

Feb 28, 2024 (Gmt+09:00)

2

Min read

News+

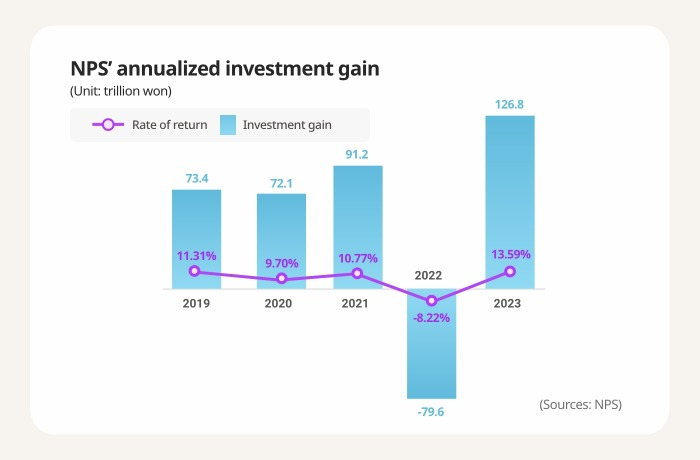

South Korea’s National Pension Service (NPS), the world’s third-largest pension fund, posted a 13.59% annualized return last year, making its net asset value 1,035.8 trillion won ($776.5 billion) as of the end of 2023.

The return rate is the highest since its fund management arm was established in 1999, the state-run fund said on Wednesday. Gains from investment for the last year totaled 126.8 trillion won, about 22% of the pension fund’s cumulative returns since its inception.

The majority of profits came from listed stocks, NPS said. Domestic and overseas stocks achieved 22.12% and 23.89% returns, respectively. Local and overseas bonds respectively logged 7.4% and 8.84% returns.

Alternative investments posted a 5.8% return last year. As of the end of last September, private equity and debt accounted for 6.9% of the pension fund’s total assets. Private real estate and infrastructure made up 5.3% and 4.2%, respectively.

About 73 trillion won of the 126.8 trillion won return came from overseas assets.

The return from offshore assets was more than 50.31 trillion won, the combined operating profits achieved by Korea’s 10 major exporters last year – Hyundai Motor Co., Kia Corp., Samsung Electronics Co., LG Electronics Inc., POSCO Holdings Inc., Samsung C&T Corp., Hyundai Mobis, LG Energy Solution Ltd., Doosan Enerbility Co. and S-Oil Corp.

NPS’ fund management arm is set to increase flexibility in its mid- to long-term asset allocation system this year, benchmarking global pension giants such as the California Public Employees’ Retirement System (CalPERS) and CPP Investments (CPPI).

The Korean pension fund will also revise its guidelines to introduce a new system for asset allocation, change its benchmarks and improve investment performance evaluation.

In Korea, having one of the world’s fastest-aging populations, NPS’ assets are forecast to start running a deficit from 2041 and be depleted by 2055.

The government and the parliamentary pension reform committee have been discussing policies to slow the depletion, by measures such as raising the pension premium rate, but have yet to propose detailed measures.

Write to Byeong-Hwa Ryu at hwahwa@hankyung.com

Jihyun Kim edited this article.

More To Read

-

Jan 17, 2024 (Gmt+09:00)

-

Jan 15, 2024 (Gmt+09:00)

-

Jan 02, 2024 (Gmt+09:00)

-

Shareholder activismNPS chief questions fairness in POSCO’s CEO selection process

Shareholder activismNPS chief questions fairness in POSCO’s CEO selection processDec 29, 2023 (Gmt+09:00)

-

Pension fundsKorea's NPS taps Jun Ahn as real estate investment head

Pension fundsKorea's NPS taps Jun Ahn as real estate investment headDec 14, 2023 (Gmt+09:00)