-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

LG Chem to close base chemical styrene monomer business

Petrochemicals

LG Chem to close base chemical styrene monomer business

The company is also mulling shuttering other general-purpose chemicals plants for ethylene oxide and ethylene glycol

By

Mar 13, 2024 (Gmt+09:00)

3

Min read

News+

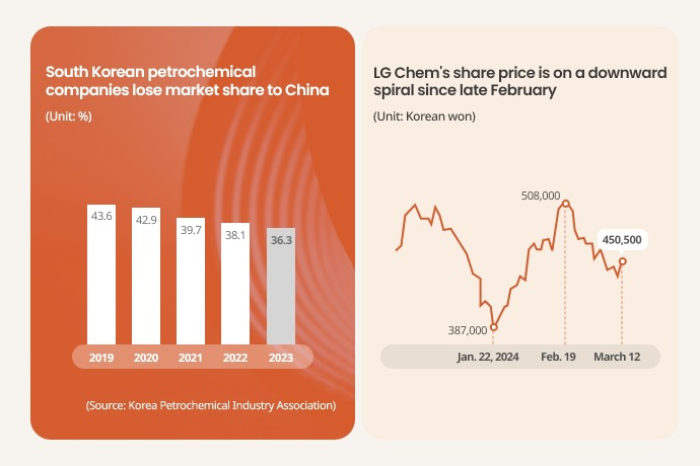

LG Chem Ltd., South Korea's No. 1 petrochemical company, will shut down its styrene monomer (SM) production line this month and is mulling closing another base chemical production facility in the country to withdraw from the general-purpose chemicals market flooded with low-priced Chinese products.

The company recently decided to cease operations of the SM production facility with an annual capacity of 150,000 tons in Yeosu, South Jeolla Province, at the end of this month, according to sources with knowledge of the matter on Tuesday.

It will transfer about 40 employees working at the facility to its other plants.

The decision came less than a year after it shut down another SM plant with a capacity of 500,000 tons in Daesan, South Chungcheong Province, pulling out of the market where Chinese peers’ aggressive inroads are driving prices sharply lower.

SM is widely used in making various types of synthetic rubber.

CHEAPER TO IMPORT THAN PRODUCE DIRECTLY

It is said that LG Chem is also considering shuttering its ethylene oxide (EO) and ethylene glycol (EG) production lines at the Daesan complex because it is no longer able to make ends meet due to massive imports of low-price Chinese products.

“The more the factory operates, the more losses it incurs. It would be better to import it than produce it directly,” said a Korean petrochemical company official.

EO is added to construction materials such as cement and is widely used in household chemical products such as shampoos, disinfectants and laundry detergent.

EG is a vital ingredient for the production of polyester fibers, film as well as automotive antifreeze and coolants.

BUSINESS RESTRUCTURING

As part of its business restructuring, LG Chem is also in talks with Kuwait Petroleum Corp. to sell a stake in a domestic naphtha cracking center after it failed to sell the facility last year.

The business reshuffles come as LG Chem has been accelerating its shift toward high-value products such as battery materials and specialty chemicals and away from base petrochemicals given severe price competition with the Chinese.

LG Chem lowered the operation rate of its plant of high-density polyethylene (HDPE), a synthetic resin, and sold its information technology (IT) film plants in Cheongju and Ochang, North Chungcheong Province, to Chinese companies last year.

HDPE is commonly used in making containers for milk, motor oil, shampoos and conditioners, soap bottles, detergents and bleaches.

In 2023, the operating rate of its ethylene and synthetic resin plants also fell to the low 70% range, near the break-even point, from over 90% in 2020.

Lotte Chemical Corp. has followed suit. In 2023, the second-largest petrochemical company in South Korea withdrew from the base petrochemical product market in China by selling its stakes in two Chinese joint ventures producing ethylene oxide.

It recently embarked on the process of selling its Malaysian unit Lotte Chemical Titan Holdings. The company is expediting its shift toward high value-added acrylonitrile butadiene styrene (ABS) and polycarbonate, used in automobiles, home appliances, and smartphones.

China’s dumping of petrochemical products also has kept Hyosung TNC Corp. from expanding into the market of butanediol (BDO), a spandex raw material business.

“Domestic petrochemical companies will remain under attack from low-priced Chinese products in the short term,” said a Korean petrochemical company official.

“But if we use this challenge as an opportunity to reorganize our business, we will be able to occupy a larger market in the future.”

Write to Hyung-Kyu Kim and Woo-Sub Kim at khk@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Mergers & AcquisitionsLotte puts Lotte Chemical Titan in Malaysia on market

Mergers & AcquisitionsLotte puts Lotte Chemical Titan in Malaysia on marketMar 06, 2024 (Gmt+09:00)

-

Oct 09, 2023 (Gmt+09:00)

-

Sep 27, 2023 (Gmt+09:00)

-

Corporate restructuringLG Chem to sell film factories amid shift to new growth drivers

Corporate restructuringLG Chem to sell film factories amid shift to new growth driversAug 23, 2023 (Gmt+09:00)

-

PetrochemicalsLotte Chemical sells off debt-ridden JV to China's Sanjiang

PetrochemicalsLotte Chemical sells off debt-ridden JV to China's SanjiangAug 16, 2023 (Gmt+09:00)

-

Corporate restructuringLG Chem seeks to sell 2nd NCC facility in Korea in face of China’s ascent

Corporate restructuringLG Chem seeks to sell 2nd NCC facility in Korea in face of China’s ascentJul 02, 2023 (Gmt+09:00)