-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korean unicorns’ failed global expedition causes growth concern

Korean startups

Korean unicorns’ failed global expedition causes growth concern

South Korea’s No. 1 food delivery app Baemin and finance super app Toss exited from Vietnam due to mounting losses

By

Apr 16, 2024 (Gmt+09:00)

3

Min read

News+

Woowa Brothers Corp. and Viva Republica Inc., South Korea’s most valuable unicorns, have pulled the plug on some of their overseas businesses after failing to win the hearts of local consumers, raising concerns over their future growth momentum.

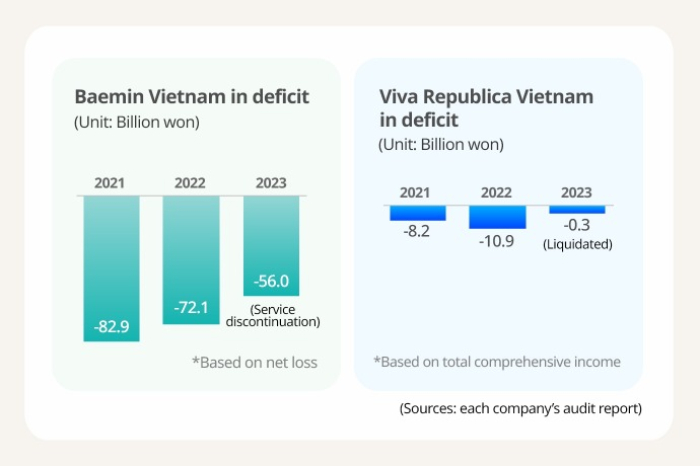

Woowa Brothers said in its audit report for 2023 that it discontinued operations of its food delivery app Baedal Minjok, or Baemin, in Vietnam last year, five years after its venture into the Southeast Asian market.

Its Vietnam operation Baemin Vietnam suffered from consecutive losses after failing to lure local consumers away from its bigger regional rivals Grab and ShopeeFood, which control 45% and 41% of the country’s online food ordering and delivery market, respectively, said a company official.

Baemin, Korea’s No. 1 food delivery app, advanced into about 10 cities in Vietnam and spent a lot on marketing to attract local people but its plans did not pan out, causing the company massive losses, the official added.

WBV Retail Co., Woowa Brothers’ retail operation in Vietnam in charge of meal kits and grocery delivery services, also shuttered its business less than a year after its launch.

Woowa Brothers is a Korean unicorn operating the country’s largest food delivery app Baemin, and it was acquired by German multinational online food ordering and delivery company Delivery Hero in 2021.

Industry experts attributed the Korean startup’s failure in developing its unique localization strategies that could meet local people’s special demands to its defeat by bigger regional rivals in Vietnam.

A lack of communication with the local government on country-specific regulations and policies is also blamed for Korean startups’ early withdrawals from the market.

EXITS BY OTHER KOREAN UNICORNS

Woowa Brothers is not the only Korean unicorn, valued at over $1 billion, which has stumbled during global expansion.

Viva Republica, the operator of the country’s finance super app Toss, also shut down Toss South East Asia, its Southeast Asian business headquarters based in Singapore, last year, only a year after its establishment.

It made inroads into Vietnam with Toss armed with non-financial services such as pedometer rewards in 2019 and then later offered fintech services such as small loans, issuance of virtual prepaid cards and credit rating services.

The app secured more than 3 million local users for its pedometer reward service in the Southeast Asian country but failed to grow into a major financial platform.

Its plan to introduce new financial services in the market also hit a snag due to the Vietnamese government’s and central bank’s strict regulations.

As of 2022, Toss operations in Vietnam recorded 10.9 billion won ($7.8 million) in comprehensive deficit. It liquidated its Vietnamese operations last year.

Jobis & Villains, the Korean startup operator of artificial intelligence-powered accounting platform 3.3, also closed its UK operations last year, less than a half year after its launch there.

Danggeun Market Inc. is also struggling in Canada and Japan, where in both countries it operates the hyperlocal marketplace and community app Karrot, which is very popular in Korea.

Bucketplace Co.’s home interior and decoration platform O!House has not yet seen a dramatic rise in users in foreign markets, including Japan, Singapore and the US.

NEED MORE TAILORED STRATEGIES FOR DIFFERENT MARKETS

So many Korean companies quickly gave up their businesses in Vietnam after failing to find reliable local resources to help them address various domestic issues, ranging from legal to regulatory and taxation, said a chief executive of a Korean startup operating in Southeast Asia.

An overseas operation head of a Korean venture capital firm also cited low-income base and purchasing power in Southeast Asian countries for Korean startups’ failure to generate profit in these markets, especially in the healthcare, fashion and game businesses.

A series of Korean unicorns’ global expansion flops raises concern that they will soon hit their growth ceiling.

As they are already major players in their respective markets in Korea, they need to find new opportunities abroad.

But what they have found so far in overseas markets is their lack of competitive edge to help them against global rivals.

Write to Eun-Yi Ko at koko@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returns

Tech, Media & TelecomDelivery Hero-backed Baemin to exit Vietnam on low returnsNov 27, 2023 (Gmt+09:00)

-

Nov 20, 2023 (Gmt+09:00)

-

Feb 03, 2022 (Gmt+09:00)

-

Mergers & AcquisitionsKorea’s Toss operator invests $5 mn in US startup fintech platform Republic

Mergers & AcquisitionsKorea’s Toss operator invests $5 mn in US startup fintech platform RepublicNov 24, 2021 (Gmt+09:00)

-

Jun 23, 2021 (Gmt+09:00)

-

Mar 31, 2021 (Gmt+09:00)

-

Mergers & AcquisitionsDelivery Hero welcomes Baemin, seeks new home for Yogiyo

Mergers & AcquisitionsDelivery Hero welcomes Baemin, seeks new home for YogiyoDec 28, 2020 (Gmt+09:00)