-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Near-zero interest rate deposits swell at Korean banks

Banking & Finance

Near-zero interest rate deposits swell at Korean banks

Cash management accounts at Korean brokerage firms expanded to a record $61 billion

By

May 09, 2024 (Gmt+09:00)

2

Min read

News+

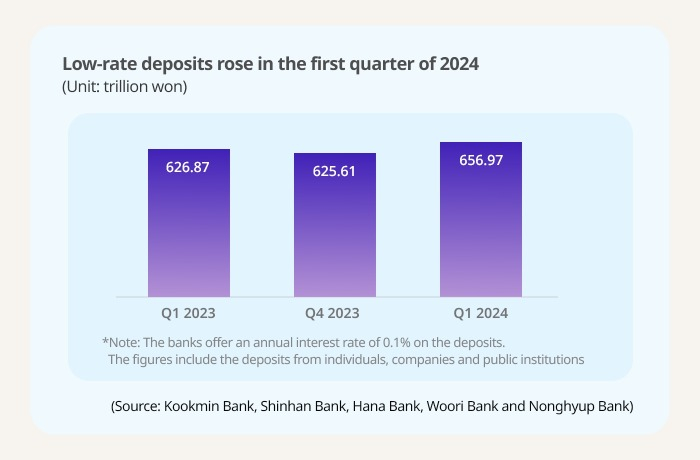

Demand and short-term deposits at South Korea’s top five banks have expanded 5% to 657 trillion won ($480 billion) in the first quarter of this year from the preceding three months, according to calculations of the banks.

With hopes for an imminent US rate cut waning on the back of robust economic growth and persistent inflation, investors opted to park money into cash assets, finding no alternatives to real estate, cryptocurrencies and the domestic stock market, which fared worse than expected.

Demand deposits at the five lenders – Kookmin, Shinhan, Hana, Woori and Nonghyup -- swelled to 647.9 trillion won as of the end of March, from 590.1 trillion won as of the end of January.

Including other deposits that can be withdrawn at any time, the balance of nearly non-interest-bearing deposits at the banks increased to 657.0 trillion won as of the end of the first quarter, compared with 625.6 trillion won three months before.

They offer a meager 1% interest rate on average per annum.

In April, the balance shrank by 31.6 trillion won after 25 trillion won moved out of the banks to subscribe to the initial public offering of HD Hyundai Marine Solution Co., a vessel maintenance and aftersales service firm. The country’s largest IPO in more than two years debuted on the Korea Exchange on Tuesday.

The following shows the balance of demand and other short-term deposits at the five lenders as of the end of March.

OUTFLOWS FROM TERM DEPOSITS

Meanwhile, term deposits contracted by 13.4 trillion won to 872.9 trillion won at the top five banks as of the end of April, compared to two months earlier.

With the deposit growth, domestic banks have cut interest rates on term deposits. The average interest rates on one-year term deposits at the five banks were lowered by 0.35-0.4 percentage points to 3.50-3.60% as of May 8, matching or close to the country’s policy rate of 3.50%.

Annual interest rates on banks’ savings accounts slid to an average of 3.58% in March from 4.18% in November last year, according to the Bank of Korea.

RISING INTEREST INCOME

The drop in deposit interest rates bolstered their interest income and will help them recover from poor results in the first quarter of this year and full-year 2023.

Interest income at the five lenders expanded by 4.6% to a combined 10.6 trillion won in the first quarter, compared with the year-earlier period.

Despite a decrease in deposit rates, they pulled lending rates higher under the pretext of the government policy to contain household loan growth.

CASH MANAGEMENT ACCOUNTS AT RECORD HIGH

Stock investors also parked money into liquid funds.

Cash management accounts and money market funds at brokerage firms have seen heavy money inflows since the end of March when the US Treasury yield headed north.

Their cash management accounts rose 3.4% to a record 83.8 trillion won ($61 billion) as of May 7, compared with the previous month, according to the Korea Financial Investment Association.

Money market funds expanded 11.07% to 193.6 trillion won as of May 7 from the month before.

Write to Bro-Hyung Kim and Eui-Jin Jeong at kph21c@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Apr 30, 2024 (Gmt+09:00)

-

Apr 23, 2024 (Gmt+09:00)

-

Banking & FinanceForeign banks expand Korean operations amid China’s slowdown

Banking & FinanceForeign banks expand Korean operations amid China’s slowdownApr 18, 2024 (Gmt+09:00)

-

Banking & FinanceS.Korea asks savings banks to raise capital to avoid crisis

Banking & FinanceS.Korea asks savings banks to raise capital to avoid crisisApr 15, 2024 (Gmt+09:00)

-

Banking & FinanceKorean savings banks swing to loss after 9 years

Banking & FinanceKorean savings banks swing to loss after 9 yearsMar 22, 2024 (Gmt+09:00)

-

Banking & FinanceKorean banking groups see record-high loan losses in 2023

Banking & FinanceKorean banking groups see record-high loan losses in 2023Feb 27, 2024 (Gmt+09:00)

-

Banking & FinanceKorean banks enjoy robust earnings in Asian emerging markets

Banking & FinanceKorean banks enjoy robust earnings in Asian emerging marketsDec 05, 2023 (Gmt+09:00)