-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Daol PE buys Youngil Glass to ride Korean cosmetics boom

Mergers & Acquisitions

Daol PE buys Youngil Glass to ride Korean cosmetics boom

The PE firm will expand automation at the glass container maker's factories and install professional managers

By

Mar 20, 2025 (Gmt+09:00)

1

Min read

News+

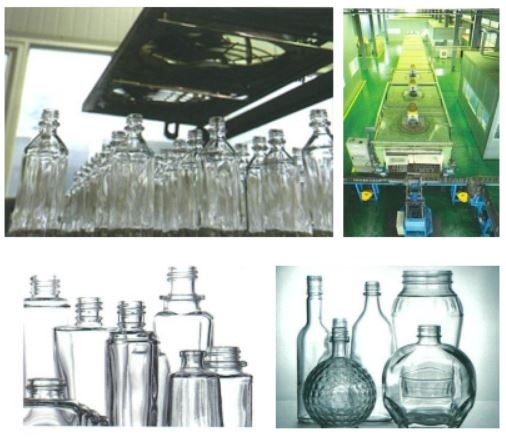

Daol Private Equity has acquired Youngil Glass Industry Co., a South Korean manufacturer of glass containers, in a 65 billion won ($44.5 million) deal, to ride on the global rise of independent Korean skincare brands.

The Seoul-based private equity firm, specializing in middle-market buyouts, has completed the purchase of a 100% stake in Youngil Glass from its founding family earlier this week, according to investment banking sources.

It aims to expand the small-sized container maker into a global leader in the cosmetics packaging market. Daol PE will bring in professional management and enhance operations through data-driven smart factory systems.

Founded in 1972, Youngil Glass focuses on cosmetic glass containers. It operates two factories in Hwaseong, about 40 kilometers from Seoul, with a combined annual capacity of 180 million units.

It counts some 100 domestic and foreign cosmetics makers as clients, including LG H&H Co., as well as budget-friendly brands such as Nature Republic Co. and Skin Food Co.

Daol PE is betting on the growth of Korean indie brands in the beauty market.

Many indie skincare brands outsource production to third-party manufacturers while sourcing containers from packaging specialists like Youngil Glass.

In 2023, Youngil Glass swung to a profit of 326.0 million won from a loss of 1.3 billion won in the year prior. Its revenue grew 19% on-year to 17.3 billion.

Samil PwC managed the sale to Daol PE.

Write to Jong-Kwan Park at pjk@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

-

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woes

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woesFeb 06, 2025 (Gmt+09:00)

-

Beauty & CosmeticsSales of K-Beauty surges in US e-commerce

Beauty & CosmeticsSales of K-Beauty surges in US e-commerceJan 21, 2025 (Gmt+09:00)

-

Jan 16, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKL & Partners buys cosmetics brand Manyo Factory for $130 mn

Mergers & AcquisitionsKL & Partners buys cosmetics brand Manyo Factory for $130 mnJan 06, 2025 (Gmt+09:00)

-

Beauty & CosmeticsKorean cosmetics beat Chanel, Lancôme to rank top in US, Japan

Beauty & CosmeticsKorean cosmetics beat Chanel, Lancôme to rank top in US, JapanJan 05, 2025 (Gmt+09:00)

-

Dec 31, 2024 (Gmt+09:00)

-

Shareholder activismDalton Investments raises stake in cosmetics ODM Kolmar

Shareholder activismDalton Investments raises stake in cosmetics ODM KolmarNov 06, 2024 (Gmt+09:00)

-

Chemical IndustryLG Chem targets functional cosmetics market with bio-materials

Chemical IndustryLG Chem targets functional cosmetics market with bio-materialsOct 17, 2024 (Gmt+09:00)

-

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platforms

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platformsSep 26, 2024 (Gmt+09:00)

-

Beauty & CosmeticsAPR enters UK cosmetics market

Beauty & CosmeticsAPR enters UK cosmetics marketSep 10, 2024 (Gmt+09:00)

-

Beauty & CosmeticsShinsegae buys low-cost cosmetics brand Amuse from Naver Snow

Beauty & CosmeticsShinsegae buys low-cost cosmetics brand Amuse from Naver SnowAug 05, 2024 (Gmt+09:00)

-

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exports

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exportsJul 17, 2024 (Gmt+09:00)

-

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands grow

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands growJan 18, 2024 (Gmt+09:00)

-

Beauty & CosmeticsShinsegae targets global luxury cosmetics market with own brand

Beauty & CosmeticsShinsegae targets global luxury cosmetics market with own brandOct 11, 2023 (Gmt+09:00)