-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Koreans’ craving for luxury goods fades

Retail

Koreans’ craving for luxury goods fades

Sales of global high-fashion brands are falling in the country; Local luxury fashion platforms face a liquidity crunch

By

Mar 28, 2025 (Gmt+09:00)

3

Min read

News+

Until recently, it was not unusual to see people waiting in a long line in front of foreign haute couture brands’ stores early in the morning in South Korea, but that is not an ordinary scene anymore in a country where a taste for luxury was long seen as an appetite that would die hard.

According to Korean alternative data platform KED Aicel on Thursday, Koreans’ credit card transactions of goods of upscale fashion brands under French multinational luxury group Kering S.A. were estimated at 38.1 billion won ($26 million) in February, down 10.3% from the same month last year.

The tally, the total sales amount of Gucci, Balenciaga, Bottega Veneta, Brioni, Boucheron, Saint Laurent and Alexander McQueen, marks the lowest monthly sales of Kering brands in Korea since 2018.

Monthly card transactions of 17 LVMH brands, including Louis Vuitton and Givenchy, also fell 4.2% to 146 billion won over the same period.

Card transactions of Dior, Burberry and Chanel goods retreated 24.8%, 22.4% and 8.4% year over year, respectively.

Koreans’ spending on prestigious foreign fashion brands has rapidly cooled since the beginning of this year amid the prolonged economic slowdown, which has led the country’s middle class to tighten their purse strings.

Especially, the purchasing power of those in their 20s and 30s, who had emerged as key lavish spenders of upmarket brands in the country, has diminished greatly, leading them to turn their backs on the luxury brands.

This is a sharp reverse from Koreans’ spending trend, which has indulged in expensive haute couture items despite constant price hikes by foreign high-end fashion and jewelry brands in recent years.

A HALT TO PRICE HIKES?

Global luxury fashion houses have raised prices of their goods in Korea for the past few years, citing an increase in raw materials and labor costs.

Their pompous move was, however, driven by their confidence in Korean consumers’ seemingly never-ending affection for prestigious brands to flaunt their wealth.

In 2023, the combined sales of Hermes, Louis Vuitton, Chanel and Dior even topped 5 trillion won despite their price increases.

But since the Korean economy entered a cooling phase last year, more Koreans have tightened their belts amid no sign of imminent economic recovery.

Coupled with young consumers’ shift toward independent brands to shop small, international high-end designer brands, another price hike early this year further curbed Koreans’ spending on luxury goods, which could put the brakes on their price hikes for a while.

The only exception was Hermes, which saw sales increase in February.

Koreans’ card transactions of Hermes products jumped 19.8% on-year to 60.7 billion won in the month, widening polarization among luxury brands in Korea following the dwindling purchasing power of the middle class.

THE GOOD OLD DAYS ARE GONE

The latest change in Koreans’ shopping trends has taken a toll on the country’s luxury fashion platforms, such as Balaan, Trenbe and Must’It.

The three platforms ascended to Korea’s top three high-end fashion marketplaces during the COVID-19 pandemic.

In 2022, when pent-up demand after the end of long social distancing measures quickly elevated luxury desire in the country, Balaan’s enterprise value shot up to about 300 billion won.

The platform’s strong appeal to consumers was the cheaper prices of luxury goods compared to those sold in offline stores like fancy department stores.

The success, however, invited more competitors to join the luxury fashion platform race, crowding the market. And then, the bubble has burst, squeezing the platforms’ liquidity.

Balaan has recorded operating losses since 2022, although the loss narrowed to 10 billion won in 2023 from 37.3 billion won.

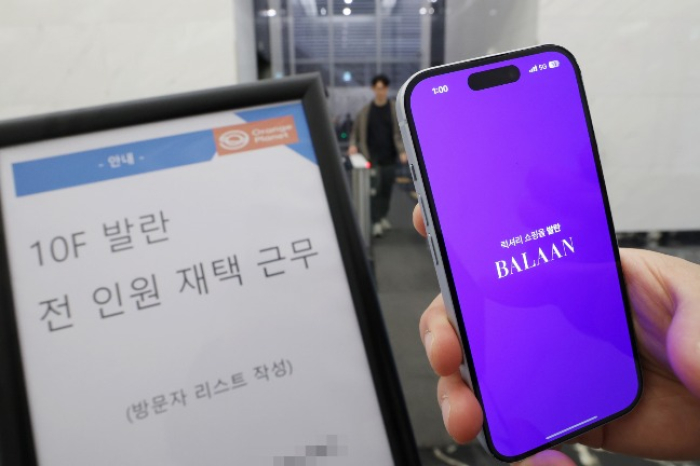

Sellers to Balaan said they have not been able to collect their money from the platform, where they sold their products, in the first three months of this year because the platform has delayed payments to them, citing system errors.

Balaan’s office in the affluent Gangnam district has been closed since Wednesday, with all of its employees working from home since then, reminiscent of third-party merchants’ nightmare late last year of delayed payments from Qoo10 Pte.’s e-commerce platform units.

Write to Yun-Sang Ko, Jae-Kwang Ahn and Hyun-jin Ra at kys@hankyung.com

Sookyung Seo edited this article.

More To Read

-

Jul 24, 2024 (Gmt+09:00)

-

Jul 16, 2024 (Gmt+09:00)

-

Jul 17, 2023 (Gmt+09:00)

-

Sep 01, 2023 (Gmt+09:00)

-

Aug 29, 2023 (Gmt+09:00)

-

Apr 14, 2023 (Gmt+09:00)

-

Feb 09, 2023 (Gmt+09:00)

-

Jul 04, 2022 (Gmt+09:00)

-

The Deep DiveBehind Korea’s bizarre 'open run' race for Chanel bags

The Deep DiveBehind Korea’s bizarre 'open run' race for Chanel bagsJun 08, 2021 (Gmt+09:00)

-

Jun 02, 2021 (Gmt+09:00)