-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Direct lending, middle market offer resilience: NYLIM

Private debt

Direct lending, middle market offer resilience: NYLIM

Private credit has virtually no duration risk, making it well suited for a rising rate environment, Apogem Chief Credit Officer Rob Douglass says

Sep 19, 2022 (Gmt+09:00)

4

Min read

News+

There is no doubt that headwinds to economic and market growth are picking up. Globally, supply chain and energy disruptions have contributed to higher inflation and other macroeconomic crunch factors.

In the US, the price squeeze is even more threatening due to persistent wage pressure. In response, central banks are tightening monetary policy. The COVID-19 impact continues to be felt. Together, these factors contribute to slowing global economic growth and rising market volatility.

Amid these challenges, it is natural for investors to ask whether now is a good time to deploy capital and, if so, where to do it. In my view, high inflation makes it more important than ever for investors to seek opportunities with stable long-term purchasing power.

In this light, private credit investments (i.e., direct lending), especially in the middle market segment, provide attractive opportunities for potential return and risk management. Below we outline a few reasons for this view and explain why we are focused on helping our Korean partners access these opportunities.

DIRECT LENDING RESILIENT TO TODAY'S MACROECONOMIC RISKS

Evidence suggests that middle market direct lending is relatively resilient to difficult macroeconomic conditions ahead, due to the specific yield and risk characteristics of the asset class.

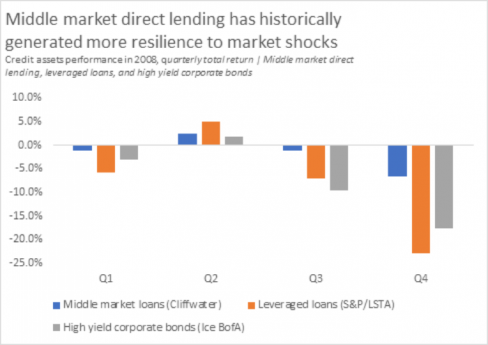

First, middle market direct lending has historically offered more downside protection than other corporate credit segments, proving more resilient than leveraged loans and high yield bonds during the worst of the 2007-2009 global financial crisis. Middle market direct lending has also generated stronger annualized results with lower volatility than these assets over the past 20 years.

As a result, the asset class has virtually no duration risk, making it well suited for a rising rate environment.

THE MIDDLE MARKET SEGMENT PRESENTS AN ATTRACTIVE OPPORTUNITY

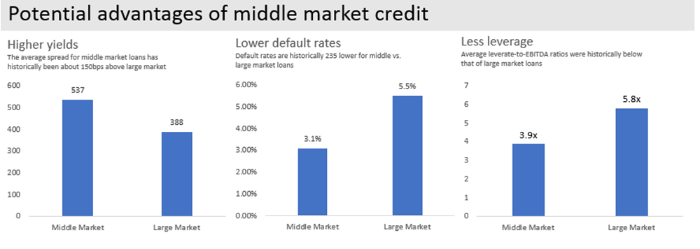

Within private markets, we believe the middle market is best positioned to navigate an economic downturn. This segment has historically outperformed during challenging periods, and we believe it continues to benefit from lower entry valuations, more conservative use of leverage, and significant pools of capital available to investors.

As presented in the charts below, middle market loans typically possess attractive characteristics relative to large corporate loans, including historically attractive yields, downside mitigation potential through lower default rates, and less leverage, enabling companies to better navigate economic downturns.

These loans are also typically at the top of the capital structure, limiting downside relative to equity investments and junior debt, and generally have better loan documentation terms, including at least one financial covenant in each contract.

DRIVERS OF SUCCESS IN PRIVATE MARKETS

So far, we have discussed the asset classes in which we have high confidence for investors. Just as important is how to deploy capital in those asset classes. As economic activity slows and volatility rises, investment performance is likely to vary even more widely among managers.

Allocators concerned about macro risks should consider the following factors when choosing an investment partner:

Exceptional credit evaluation is key in accessing the best companies and limiting risk.

Diversification of borrowers across industries helps build portfolio resiliency.

Strong partnerships, backed by a long track record in the market, provide access to the best deals and transparency into borrowers’ business operations. In our view, transparency provides meaningful value in managing risk.

Patient capital and a long investment time horizon permit investors to turn down unattractive deals, maintain a strong pipeline, and build enterprise value over economic cycles.

For New York Life Investments, this conviction in private markets and the middle market segment is not only an investment idea – it's a strategic priority. Earlier this year in April, Apogem Capital, a New York Life Investments company, was formed through the combination of PA Capital, Madison Capital Funding and GoldPoint Partners to create a singular and unified, world-class private market alternative investment firm.

With approximately $37 billion in assets under management as of March 31, 2022, Apogem has the deep relationships, data, and history in the middle market to deliver innovative solutions to both clients and sponsors.

For us, this cross-middle-market perspective is imperative to harnessing the diversification across industries, managers, and vintage years described above, as well as the investment and underwriting discipline critical to navigate challenging market cycles.

Apogem Capital offers investors access to the middle market growth engine through investments in leading private companies and funds. The firm manages a streamlined suite of capital solutions, including direct lending, junior debt, primary fund investments, secondary investments, equity-co-investments, GP stakes, private real assets and long/short equity.

By Robert Douglass

Jennifer Breen-Nicholson edited this article.

More To Read

-

Aug 15, 2022 (Gmt+09:00)

-

Jul 06, 2022 (Gmt+09:00)

-

May 23, 2022 (Gmt+09:00)

-

New York Life Investments[Discussion] Think twice before heavy inflation hedge: NYLIM

New York Life Investments[Discussion] Think twice before heavy inflation hedge: NYLIMDec 17, 2021 (Gmt+09:00)