-

KOSPI 2601.80 -1.62 -0.06%

-

KOSDAQ 715.55 +1.80 +0.25%

-

KOSPI200 347.02 +0.45 +0.13%

-

USD/KRW 1398 -4.00 0.29%

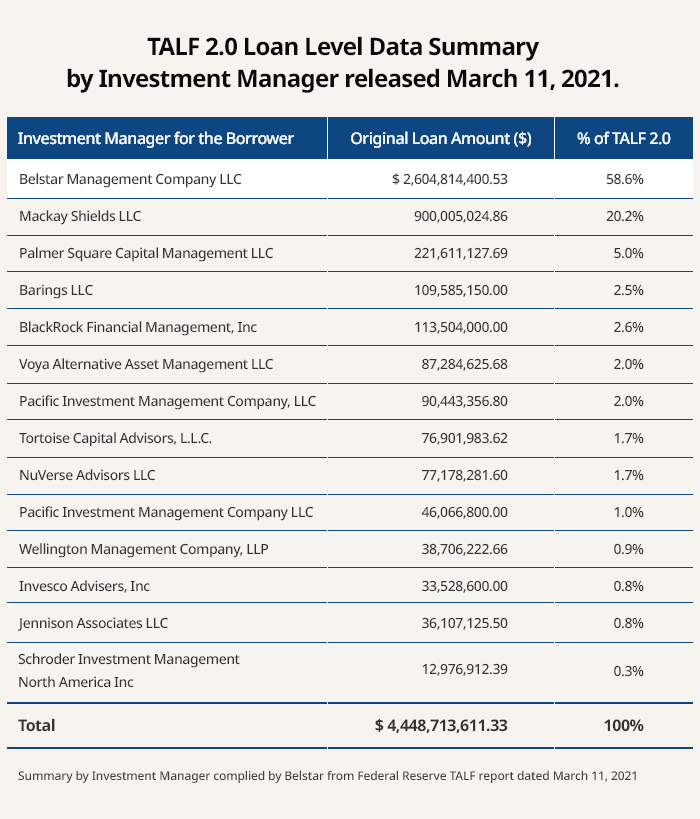

Korean institutions ranked top US liquidity provider under 2020 TALF

EMP Belstar-managed fund makes up over half of TALF's $4.5 billion program

By

Jun 17, 2021 (Gmt+09:00)

South Korean institutional investors, including the Public Officials Benefit Association (POBA) and Yellow Umbrella Mutual Aid Fund, emerged as the largest group of liquidity providers under the US Federal Reserve’s Term Asset-Backed Securities Loan Facility (TALF) program introduced in 2020.

To utilize the funding facility, New York-based EMP Belstar had raised $580 million from nine Korean institutions last year, based on which it borrowed $2.6 billion from the Fed to buy US asset-backed securities (ABS), according to the US investment firm on June 17.

The borrowing represented 56% of the $4.5 billion TALF program that recently closed, outstripping other TALF-related borrowings by global money managers like BlackRock and Barings by a big margin, data from the US Federal Reserve shows.

The TALF program was introduced by the US Treasury and the Federal Reserve Bank in both 2009 and 2020 to support lending to consumers and small business through ABS issuance.

Through TALF, the Fed lent money equivalent to about five to 20 times the principal raised by a fund at an ultra-low rate of 1%. Then the fund house used the loans to purchase AAA-rated and government-backed securities, which carry higher credit ratings than the US Treasuries rated AA+.

Back in 2009, EMP Belstar raised approximately $300 million, equaling four percent of the total $77 billion raised for the TALF program. It was among one of the top 10 TALF borrowers in 2009, while its 2009 TALF fund returned 20% per year on average.

"During the global financial crisis, it took over six months for our TALF fund to raise $300 million from Korean institutional investors, and we ranked just seventh," said Joonho Lee, head of EMP Belstar's South Korean operations.

"At the time, we struggled with their low level of understanding about asset-backed securities. But their investment expertise has improved significantly over a period of 10 years."

Last year, EMP Belstar's new TALF fund pulled in $580 million from nine South Korean institutions in just two months. It attracted $100 million each from POBA, Yellow Umbrella Mutual, Korea Scientists and Engineers Mutual-Aid Association and Lotte Non-life Insurance Co.; $70 million from National Credit Union Federation of Korea; $30 million from Hanwha General Insurance Co.; $30 million from Military Mutual Aid Association; $30 million from National Forestry Cooperative Federation; and $20 million from Hyundai Marine and Fire Insurance Co.

The US investment firm's swift deal sourcing was attributable to its quick investment execution with the borrowing from the Fed. Unlike other investment firms which bought collateralized loan obligations (CLOs) through auctions, EMP Belstar purchased CLOs in proprietary deals with the sellers before they came on the market.

"As soon as the COVID-19 pandemic started, we began preparation for a TALF program, working on the relevant fund launch," said Lee. "So we were able to exhaust 80% of the committed capital."

EMP Belstar expects its 2021 TALF fund to deliver returns of close to 10%.

Under the latest TALF program, BlackRock borrowed $113.5 million, accounting for only 2.6% of the total, followed by Barings' $109.6 million at 2.5%.

EMP Besltar was founded in 2008 by Korean-American Chairman Daniel Yun and Joonho Lee. It arranges South Korean institutions' investment in the US credit market.

In South Korea, it established Korea Superfreeze in 2015, and attracted Goldman Sachs PIA and SK Inc. as major shareholders of the cold storage company.

Write to Chae-yeon Kim and Chang Jae Yoo at why29@hankyung.com

Yeonhee Kim edited this article.

-

Jun 05, 2020 (Gmt+09:00)

-

Jul 07, 2020 (Gmt+09:00)