-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

MBK Partners’ 6th buyout fund raises $5 bn at 2nd close

Private equity

MBK Partners’ 6th buyout fund raises $5 bn at 2nd close

Its takeover attempts of South Korean companies such as Korea Zinc have won the support of its limited partners

By

Nov 19, 2024 (Gmt+09:00)

1

Min read

News+

MBK Partners, a North Asia-focused private equity firm, has completed the second closing of its sixth buyout fund at $5 billion, on course to reach its target of $7 billion at the final close.

On Monday, MBK announced the fund’s second closing. It plans to complete its third closing in the first quarter of next year.

More than 85% of its major global limited partners, led by those from North America and the Middle East, made commitments to the new fund, in addition to some global family offices, according to MBK.

The fundraising nearly matches TPG’s eighth Asia fund of $5.3 billion launched this year. But it falls short of the $6.8 billion CVC Capital raised for its sixth Asia fund early this year.

Among the Asia-focused buyout funds that have completed their second closing this year, however, MBK’s new fund has attracted the biggest amount, said MBK.

UNFRIENDLY TAKEOVER BIDS

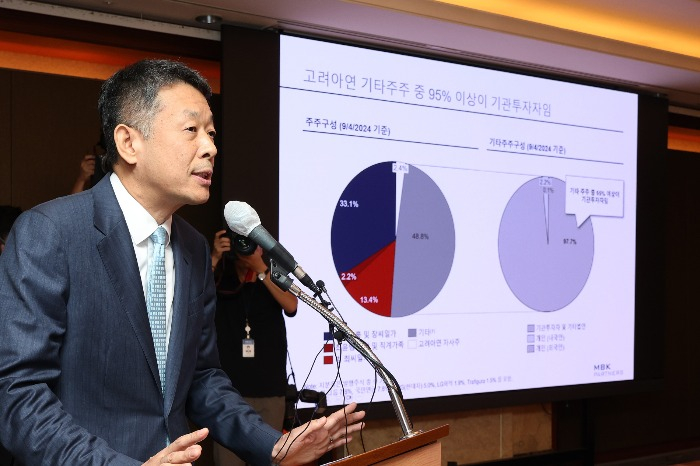

It has edged closer to winning the battle for control of Korea Zinc Inc., which MBK believes has room to improve governance and shareholder value, according to Michael ByungJu Kim, founder and chairman of MBK.

However, its attempt to buy Hankook Tire & Technology Co, South Korea's largest tire maker, fell through early this year.

Investment bankers said MBK is now more like an activist fund as it seeks to maximize returns through governance reform after some of its Korean buyouts turned sour.

Its investment strategy is expected to spur other private equity peers to take similar approaches as domestic business groups grapple with succession issues amid the descent of traditional enterprises.

Write to Yeonhee Kim at yhkim@hankyung.com

Jennifer Nicholson-Breen edited this article.

More To Read

-

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knights

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knightsOct 27, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK Partners tipped to win battle for control of Korea Zinc

Mergers & AcquisitionsMBK Partners tipped to win battle for control of Korea ZincNov 12, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder value

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder valueNov 05, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelter

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelterOct 28, 2024 (Gmt+09:00)

-

Oct 16, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifies

Mergers & AcquisitionsMBK ups Korea Zinc bid price as management feud intensifiesSep 26, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offer

Mergers & AcquisitionsMBK not to sell Korea Zinc to China after tender offerSep 19, 2024 (Gmt+09:00)

-

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea Zinc

Leadership & ManagementMBK, Young Poong seek $1.5 bn hostile bid for Korea ZincSep 13, 2024 (Gmt+09:00)

-

Aug 30, 2024 (Gmt+09:00)

-

Leadership & ManagementCho Yang-rai to fight back in MBK Partners’ bid to acquire Hankook Tire

Leadership & ManagementCho Yang-rai to fight back in MBK Partners’ bid to acquire Hankook TireDec 12, 2023 (Gmt+09:00)