Private debt

Optimizing flexibility for fixed-income in new era: M&G

Emerging market local currency bonds are attractive due to strong and positive real yields compared with developed markets, M&G's Pierre Chartres says

Jul 03, 2023 (Gmt+09:00)

7

Min read

Most Read

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

Korea's Lotte Insurance put on market for around $1.5 bn

Fixed-income continues to offer an attractive entry point for investors with higher yields, declining inflation and the end of the interest rate hiking cycle in sight. Investors should be flexible in their allocations from high-quality government bonds and corporate credit to emerging market local currency bonds and even some high yields.┬Ā

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

Global investors continue to embrace the current environment of higher yields. Coupled with greater clarity over the outlook for rates and inflation, this gradual easing of the macro dynamics that disrupted global markets and portfolios in 2022 is creating renewed pockets of opportunity across certain parts of the fixed-income landscape.┬Ā

For example, at both the longer and shorter ends of the yield curve, the risk/return ratio of government bonds has greatly improved for the first time in many years. In the investment-grade corporate credit space, meanwhile, exposure to higher-quality banking, utilities, media and telecom businesses looks appealing to us at the moment.

At the other end of the risk spectrum, we think high-yield investors could again find value on a selective basis, given the attractive level of carry-on offer in many areas and the relatively low leverage levels of many companies.┬Ā

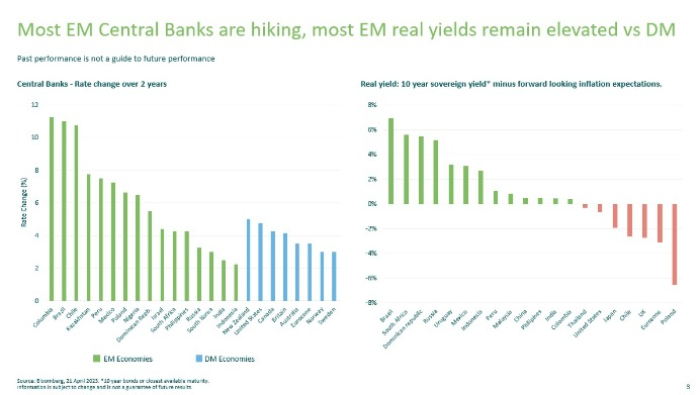

Looking geographically, we see emerging market local currency bonds as attractive due to strong and positive real yields compared with developed markets, spurred by pre-emptive moves by many emerging market central banks to start hiking before the Federal Reserve.

Despite various promising entry points into fixed-income, the lingering cloud of uncertainty and volatility makes it important for investors to take a flexible approach when allocating to these assets.┬Ā

COMING TO TERMS WITH THE ECONOMIC RESET┬Ā

After a tumultuous 18 months or so, signs are emerging that the headwinds from rising interest rates and soaring inflation are gradually dissipating.

For a start, we believe we are nearing the end of relentless hikes to US interest rates. Based on patterns of tightening cycles since the early 1970s, we think hiking will stop once rates move durably above inflation.

This echoes comments by US Fed Chairman Jerome Powell in September 2022: ŌĆ£You want to be at a place where real rates are positive across the entire yield curve.ŌĆØ With interest rates now at 5.25% and inflation gradually declining, we believe we have reached this very important juncture for the US economy.┬Ā

┬Ā

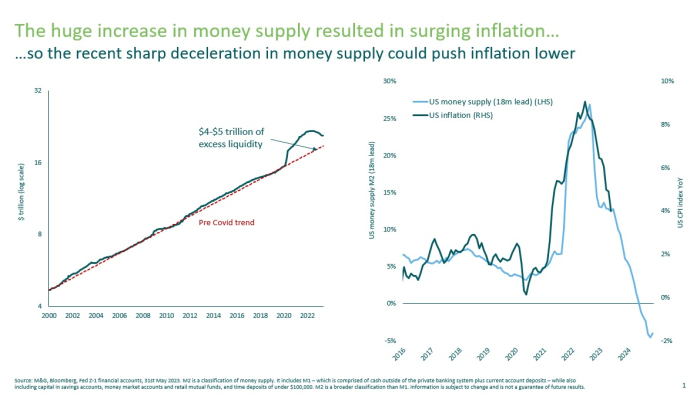

Ultimately, the market outlook will depend on the inflationary scenario. Contrary to the views of many commentators, we consider the primary driver of the inflationary spike to be the vast amounts of liquidity that governments injected in the early days of the Covid crisis, and that central banks created as they lowered rates and implemented quantitative easing.

While the deceleration in money supply is now squeezing the excesses created, given the magnitude of previous stimulus measures, we expect it to take some time to bring inflation back down to its target of 2%.

The historically low levels of unemployment in the global labor markets will likely be another factor slowing the pace at which inflation falls. On the flip side, the high demand for workers against a relatively limited supply, especially in the US, lowers the chances of a hard landing for the global economy.

Against this macro backdrop, investors can find attractive and diversified risk-adjusted returns within a wide range of government and corporate bonds, across investment-grade and high yield, and from developed countries to emerging markets.

GOVERNMENT BONDS┬Ā

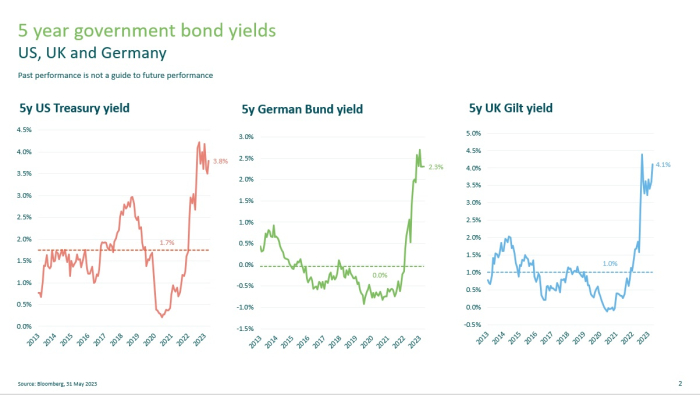

The inflation spike has meant that US Treasury yields have broken out of their rangebound territory. A 30-year inflation-linked US treasury bond with a yield of 1.6% could generate a 1.6% real return over the long term, according to Bloomberg data as of May 31, 2023. This type of instrument can serve as akin to an insurance policy for portfolios, given there will likely be bouts of volatility and inflation could remain stubbornly elevated in the near term.

A similar boost to government bond yields can also be seen at the shorter end of the curve globally ŌĆō including with five-year German Bunds and UK Gilts.

With these opportunities in mind, we are finding that our unconstrained approach enables us to add duration within portfolios across regions, in turn helping investors capitalize on the benefits of changing bond yields and diversification. Based on our view that yields can only rise so far if inflation stabilizes, now seems a good entry point.

CORPORATE BONDS┬Ā

Within the credit space, we think there is room for spreads to compress, so we generally see value in global investment-grade corporate bonds. And with a total face value of over $10 trillion in this asset class from around 2,000 issuers in diverse sectors, according to ICE BoFA Global Corporate Index as of May 31, 2003. It represents a formidable terrain for active managers such as ourselves to add value for our clients.

In particular, for global investors hunting value, an allocation to European and UK corporate bonds has driven outperformance versus US corporate bonds in recent times. This is based on the appeal of European credits, with regional valuations in favor of European investment-grade bonds compared with their US counterparts following the disruptions of 2022.┬Ā

From a sector perspective banking stands out in the more highly rated segment ŌĆō especially with the larger institutions, which are well-capitalized and more resilient than in the past. In the BBB-rated space, the utilities, media and telecom sectors are attractive at the moment.

HIGH-YIELD DEBT┬Ā

At the other end of the risk spectrum, high-yield fundamentals have held up relatively well to date. While corporate profitability is normalizing post the COVID-19 rebound, measures of indebtedness such as total debt, net leverage and interest coverage remain at very strong levels.

As a result, while default rates may increase at the margin given the prevailing high interest rate regime, we believe these will be manageable for skilled managers. In line with this, we see potential for high-yield exposure on a selective basis.

EMERGING MARKET DEBT

We see value today in emerging market local currency bonds, with the relative strength of real yields creating support for the asset class. This is a result of many emerging market central banks undertaking rate hikes earlier than the Fed, ensuring most emerging market real yields remain elevated compared with those in developed markets.

This is a direct consequence of emerging markets learning from previous crises ŌĆō notably the need to pre-empt Fed-led rate hiking cycles in developed markets that typically lead to capital outflows in emerging market due to monetary tightening.

In our view, the market sell-off of 2022 has opened up a unique opportunity for investors to seek exposure to fixed-income assets and take advantage of attractive returns over the long term.┬Ā

Saying that, and despite the inflation-fighting stance of central banks around the world, inflation remains the biggest risk for fixed-income investors.

To counter this, we believe an unconstrained bond fund enables investors to capitalize on the range of potential opportunities in global fixed income ŌĆō by adjusting exposure to instruments that offer the most compelling risk/return characteristics at different points of the economic cycle.

By Pierre Chartres, investment director, fixed income at M&G

Prior to M&G, he spent seven years at London-based BNY Mellon, where he served as portfolio strategies and produced research for multi-asset investment solutions. Before joining BNY Mellon, he worked as a product manager at Natixis Global Asset Management in Paris for two years.┬Ā

Jihyun Kim edited this article.

More to Read

-

ASK 2023Private debt will offer both income and downside protection: ASK 2023

ASK 2023Private debt will offer both income and downside protection: ASK 2023May 17, 2023 (Gmt+09:00)

3 Min read -

Private debtDirect lending tops private debt strategy again for Korean LPs

Private debtDirect lending tops private debt strategy again for Korean LPsApr 26, 2023 (Gmt+09:00)

4 Min read -

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: Survey

Asset Owners ReportS.Korean LPs to up exposure to private debt, infrastructure in 2023: SurveyApr 19, 2023 (Gmt+09:00)

3 Min read -

ASK 2022KIC to focus on tech ventures, private debt, infrastructure

ASK 2022KIC to focus on tech ventures, private debt, infrastructureOct 26, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN