-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Korean won needs economic fundamentals recovery for rebound

The KED View

Korean won needs economic fundamentals recovery for rebound

The won has lost 5.4% vs the dollar so far this year despite expectations that the US Fed may stop interest rate hikes

By

May 16, 2023 (Gmt+09:00)

3

Min read

News+

The South Korean won is underperforming most other currencies as Asia’s fourth-largest economy is gradually losing steam for long-term growth.

The won has lost 5.4% against the dollar so far this year as of Monday, according to South Korea’s central bank data, although the US currency declined overall on expectations that the Federal Reserve is likely to end its tightening campaign soon. The dollar index, which tracks the currency’s value against a basket of six major counterparts such as the euro, skidded about 1%.

The South Korean unit depreciated more than its peers in Asia with the Japanese yen down 2.3%.

Last year, the won shed 6% as it hit 1,444.2 per dollar, the weakest since the 2008-09 global financial crisis, pressured by the Fed’s aggressive interest rate hikes to stem the rampant inflation.

The local currency had found relief from views that the US central bank may slow or stop the tightening in the near term but failed to maintain the recovery momentum.

It has been weaker than the psychologically important 1,300 versus the greenback for about a month, far softer than an average value of 1,063 for 33 years from 1999 to 2022, according to the Bank of Korea.

STRUCTURAL WEAKNESS

That indicated the won became structurally weak as the currency is usually stronger than 1,300, except when the economy faced crunches such as the 1997-98 Asian financial crisis.

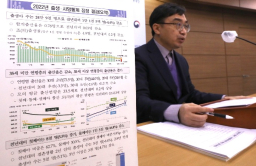

The economic fundamentals deteriorated with exports on course to fall for the eighth consecutive month on sluggish overseas sales of semiconductors. The country is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

The country was set to suffer a trade deficit for 15 months in a row while already reporting a fiscal deficit of 54 trillion won ($450.4 billion) in the first quarter.

The economy is forecast to grow by only mid-1% this year at best, slower than 2.6% in 2022. The dim outlook is likely to keep the BOK from tightening monetary policy further to narrow its interest rate differential with the US, which currently stands at a record 1.75 percentage points.

External conditions remained tough given the ongoing troubles facing US regional banks after the collapse of Silicon Valley Bank. The problems in the sector are unlikely to result in a global crisis similar to that of Lehman Brothers, but all economic subjects remain concerned over a potential meltdown.

The South Korean economy is also losing growth potential. Despite the record-low fertility and quickly aging population, the country has yet to take measures to quickly change the entire social system to address the problems.

CURRENCY INTERVENTION WILL NOT WORK

The country must stably manage the macroeconomy in the short term while improving its economic constitution in the long term for fundamental solutions.

The government needs to increase export competitiveness, ease regulations, which hinder investments, and upgrade the economic system to cope with the low birth rate and aging issues through the reforms of labor, pension and education systems.

South Korea successfully recovered from two crises in 1997-98 and 2008-09, which were short-term shocks.

The country has yet to suffer financial market turmoil, which it experienced during the past crises, but the recent won’s weakness could be a deadly alarm, warning of gradual deterioration in its economic fundamentals.

Write to Yong-Seok Ju at hohoboy@hankyung.com

Jongwoo Cheon edited this article.

More To Read

-

May 11, 2023 (Gmt+09:00)

-

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook dark

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook darkApr 21, 2023 (Gmt+09:00)

-

Apr 13, 2023 (Gmt+09:00)

-

Culture & TrendsS.Korea's elderly population to exceed 10 million in 2024

Culture & TrendsS.Korea's elderly population to exceed 10 million in 2024Feb 28, 2023 (Gmt+09:00)

-

Feb 22, 2023 (Gmt+09:00)

-

Nov 11, 2022 (Gmt+09:00)