-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Samsung shifts to emergency mode with 6-day work week for executives

Corporate strategy

Samsung shifts to emergency mode with 6-day work week for executives

The business group aims to inject a sense of crisis as geopolitical and macroeconomic risks mount

By

Apr 18, 2024 (Gmt+09:00)

3

Min read

News+

Executives at all Samsung Group units will work six days a week from as early as this week in a shift to emergency mode. The move comes as the won's sharp depreciation, rising oil prices and high borrowing costs aggravate business uncertainties after some of the group's mainstay businesses delivered poorer-than-expected results in 2023.

The executives of Samsung Electronics Co., including those in the manufacturing and sales divisions, will work either on Saturday or Sunday following the regular five-day work week, according to Samsung Group officials.

They will review their business strategies and may modify them to adapt to the changing business environment amid mounting gepolitical risks from the prolonged war between Russia and Ukraine and escalating tensions in the Middle East.

“Considering that performance of our major units, including Samsung Electronics, fell short of expectations in 2023, we are introducing the six-day work week for executives to inject a sense of crisis and make all-out efforts to overcome it,” said a Samsung Group company executive.

Top management at Samsing Display Co., Samsung Electro-Mechanics Co. and Samsung SDS Co. will adopt the six-day work week as early as this week. Samsung Life Insurance Co. and other financial services firms under the Samsung Group will likely join them soon.

Executives of Samsung C&T Corp., Samsung Heavy Industries Co. and Samsung E&A Co. have already been voluntarily working six days a week since the start of this year.

But employees below the executive level across the group will continue to work for five days a week, as the company introduced it in 2003.

In 2023, Samsung Electronics recorded an operating loss of 15 trillion won ($11 billion) in its mainstay semiconductors business. The Device Solutions division, overseeing the semiconductor business, accounts for about 80% of Samsung’s earnings.

The world’s largest memory chipmaker signaled the end to the chip market's downturn earlier this month, after posting more than a tenfold surge in preliminary operating profit in the first quarter of this year.

However, it could face headwinds from the steep depreciation in the Korean won and the upward spiral in oil prices, coupled with political risks from the US presidential election in November.

Earlier this week, the won softened to 1,400 per dollar, its weakest point since Nov. 7, 2022. Dubai oil, a benchmark index, rose to $90.26 per barrel on April 16, from $86.31 at the end of last month.

Samsung is fighting an uphill battle to overtake domestic rival SK Hynix Inc. in the growing high bandwidth memory (HBM) market, widely used for AI applications.

In the foundry field, it will grapple with a challenge from Intel Corp., which plans to manufacture chips for fabless semiconductor companies, while stepping up efforts to overtake the dominant leader TSMC.

Samsung's shift to emergency mode comes after South Korea’s energy-to-telecom conglomerate SK Group in January reintroduced Saturday gatherings of its subsidiaries' chief executives after it adopted a five-day work week in July 2000.

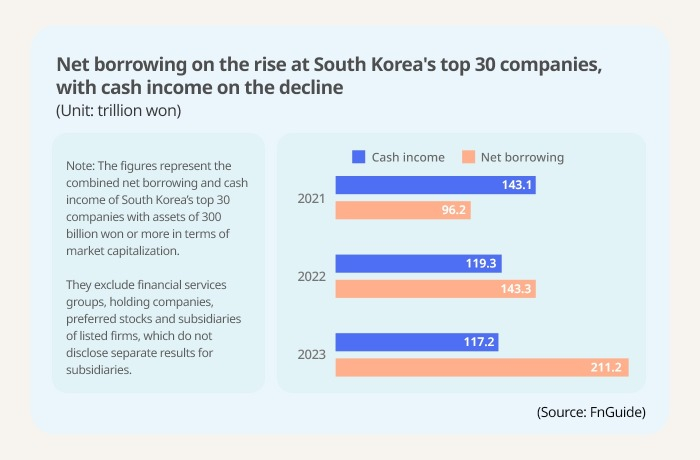

Petrochemical companies in the country are also tightening their belts to survive the industry’s downturn caused by oversupply from Chinese rivals.

LG Chem Ltd. and Lotte Chemical Corp. are accelerating business restructuring by shutting down some money-losing operations, or putting key units up for sale.

Other Korean conglomerates are expected to follow suit. The outcome of last week's general elections raises doubts about the feasibility of President Yoon Suk Yeol's business-friendly proposals.

The main opposition Democratic Party won a landslide victory in the April 10 elections to retain a majority in parliament.

Write to Jeong-Soo Hwang and Woo-Sub Kim at hjs@hankyung.com

Yeonhee Kim edited this article.

More To Read

-

Apr 17, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung to mass-produce industry’s fastest LPDDR5X DRAM in H2

Korean chipmakersSamsung to mass-produce industry’s fastest LPDDR5X DRAM in H2Apr 17, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offing

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offingApr 12, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung to more than double chip investment in Texas

Korean chipmakersSamsung to more than double chip investment in TexasApr 07, 2024 (Gmt+09:00)

-

Apr 05, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

-

Mergers & AcquisitionsSamsung Elec vies for Johnson Controls' HVAC units

Mergers & AcquisitionsSamsung Elec vies for Johnson Controls' HVAC unitsMar 25, 2024 (Gmt+09:00)

-

Mar 20, 2024 (Gmt+09:00)

-

Corporate restructuringLG Chem reshuffles R&D unit to turn into EV materials maker

Corporate restructuringLG Chem reshuffles R&D unit to turn into EV materials makerMar 18, 2024 (Gmt+09:00)

-

PetrochemicalsLG Chem to close base chemical styrene monomer business

PetrochemicalsLG Chem to close base chemical styrene monomer businessMar 13, 2024 (Gmt+09:00)

-

Jan 31, 2024 (Gmt+09:00)

-

Corporate strategySK Group reintroduces Saturday CEO meeting after 20 years

Corporate strategySK Group reintroduces Saturday CEO meeting after 20 yearsJan 24, 2024 (Gmt+09:00)