-

KOSPI 2577.27 -2.21 -0.09%

-

KOSDAQ 722.52 -7.07 -0.97%

-

KOSPI200 341.49 +0.02 +0.01%

-

USD/KRW 1396 -2.00 0.14%

Samsung holds DRAM supremacy with its market share at 7-year high

Korean chipmakers

Samsung holds DRAM supremacy with its market share at 7-year high

Its DRAM sales to continue their uptrend this year, driven by high-end products such as DDR5 and the HBM series

By

Feb 27, 2024 (Gmt+09:00)

2

Min read

News+

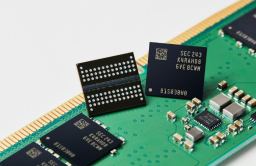

Samsung Electronics Co., the world’s largest memory chipmaker, saw its supremacy in the DRAM segment strengthen last year with its market share hitting its highest point in seven years.

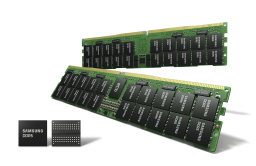

The Suwon, South Korea-based tech giant’s DRAM chip market share stood at 45.7% in the fourth quarter of 2023, according to data from market researcher Omdia on Tuesday. That represents Samsung’s biggest slice of the pie since the third quarter of 2016 when it controlled 48.2% of the market.

From the third quarter, Samsung’s DRAM market share increased by 7 percentage points, further widening the gap with its rivals.

SK Hynix Inc. ranked second with a 31.7% market share in the fourth quarter, followed by Micron Technology Inc., which garnered a 19.1% share.

Samsung’s fourth-quarter DRAM sales revenue rose 21% from the previous quarter and 39% from the year-earlier period, posting its first on-quarter and on-year gains in one-and-a-half years.

The company’s average DRAM sale price increased by 12% quarter on quarter, driven by a rise in mobile DRAM prices. Its fourth-quarter DRAM chip shipments advanced 16% from the previous quarter.

VALUE-ADDED CHIPS

Its decent revenue growth was supported by brisk sales of high-value-added products such as DDR5 DRAM and high bandwidth memory (HBM) chips.

Samsung and its crosstown rival SK Hynix are two dominant players in the HBM chip market.

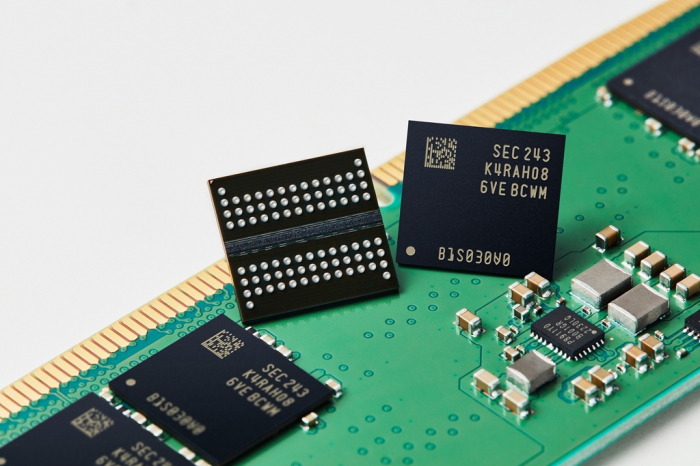

DDR5, short for double data rate 5, is the next-generation DRAM chip, boasting faster speed and higher density with reduced power consumption compared to previous DDR4 chips. The latest memory is suitable for data-intensive supercomputing, artificial intelligence (AI) and machine learning applications.

With exponential data growth, DDR5 is becoming the new standard in the DRAM segment.

The HBM series of DRAM is in growing demand as the chips power generative AI devices that operate on high-performance computing systems.

NEXT BATTLEFIELD

Such chips are used for high-performance data centers as well as machine learning platforms that enhance the AI and super-computing performance level.

Last November, Samsung launched a business unit tasked with developing next-generation chip processing technology as the company aims to take the lead in the AI chip segment.

According to market tracker TrendForce, the global HBM market is forecast to grow to $8.9 billion by 2027 from an estimated $3.9 billion this year.

Last October, Samsung said it plans to unveil next-generation HBM4 chips in 2025 as part of its push to lead in the AI chip sector.

Analysts expect Samsung’s DRAM sales to continue their uptrend this year.

The company plans to advance its chip interconnecting technology called through silicon via (TSV) and expand related production capacity to the industry's highest level this year to hike HBM chip production volumes.

Write to Chae-Yeon Kim at why29@hankyung.com

In-Soo Nam edited this article.

More To Read

-

Korean chipmakersSamsung doubles down in HBM race with largest memory

Korean chipmakersSamsung doubles down in HBM race with largest memoryFeb 27, 2024 (Gmt+09:00)

-

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip era

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip eraJan 12, 2024 (Gmt+09:00)

-

Korean chipmakersSamsung set to supply HBM3 to Nvidia, develops 32 Gb DDR5 chip

Korean chipmakersSamsung set to supply HBM3 to Nvidia, develops 32 Gb DDR5 chipSep 01, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung, SK Hynix in next-generation HBM chip supremacy war

Korean chipmakersSamsung, SK Hynix in next-generation HBM chip supremacy warJul 10, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung rolls out industry’s finest 12 nm DDR5 DRAM chips

Korean chipmakersSamsung rolls out industry’s finest 12 nm DDR5 DRAM chipsMay 18, 2023 (Gmt+09:00)

-

Korean chipmakersSamsung, Qualcomm unveil industry’s fastest LPDDR5X DRAM chip

Korean chipmakersSamsung, Qualcomm unveil industry’s fastest LPDDR5X DRAM chipOct 18, 2022 (Gmt+09:00)

-

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK Hynix

Korean chipmakersMicron’s entry into DDR5 market: A boon for Samsung, SK HynixAug 30, 2022 (Gmt+09:00)

-

Korean chipmakersSamsung makes industry’s smallest 14 nm DDR5 chip with EUV technology

Korean chipmakersSamsung makes industry’s smallest 14 nm DDR5 chip with EUV technologyOct 12, 2021 (Gmt+09:00)

-

Korean chipmakersSamsung widens lead over rivals with industry’s first advanced DDR5

Korean chipmakersSamsung widens lead over rivals with industry’s first advanced DDR5Mar 26, 2021 (Gmt+09:00)